Germany should not run the ECB

If Jens Weidmann became president of the European Central Bank (ECB), it would be more difficult to fight the next recession and prevent future crises.

Bundesbank boss Jens Weidmann wants to succeed Mario Draghi as President of the ECB, that much is clear. It is also clear that making him president would be a mistake. To meet the challenges that lie ahead – a weakening eurozone economy and a potential debt crisis in Italy – the ECB will need to implement bolder monetary policy than seen to-date and to preserve its role as de facto lender of last resort to governments. The eurozone needs someone even bolder than Draghi – not a conservative like Weidmann, who has been reluctant to support or outright opposed to some of the ECB’s recent policies. Moreover, Germany already dominates eurozone policy-making through its veto on further reforms and on the use of the main bailout fund, the European Stability Mechanism (ESM). To appoint a German to lead the ECB would be a step too far.

Draghi’s mixed legacy

In November 2011, Draghi took over from Jean-Claude Trichet. At the time, the ECB was far too cautious. During the acute phase of the euro crisis, Trichet had only intervened reluctantly to stabilise government bond markets, arguing that it was the job of governments to fix the eurozone, not the ECB’s. He had fiercely resisted debt restructuring in Greece for fear of contagion. His monetary policy had mechanically followed the near-term rate of inflation – he famously hiked rates in 2008 and 2011, in the middle of crises – failing to appreciate that a full-blown financial crisis, not inflation, was the real threat.

Draghi reversed Trichet’s rate hikes within the first six weeks of his term, and provided Europe’s banks with almost €500 billion of cheap long-term funding to avert a liquidity crisis. In the summer of 2012, Draghi famously pledged “to do whatever it takes” to preserve the euro. He followed up that pledge with a programme called OMT (Outright Monetary Transactions), promising to buy government bonds in unlimited quantities to stabilise sovereign debt markets if necessary. It is widely agreed that this pledge – to make the ECB the de facto lender of last resort to governments – was the key to arresting the euro crisis. Under Draghi’s leadership, the ECB also started a programme of bond purchases (commonly known as QE, or ‘quantitative easing’) in early 2015 to stimulate the economy.

Draghi is rightly praised for arresting the euro crisis. But overall, his monetary policy record is mixed.

Draghi is rightly praised for arresting the euro crisis. But overall, his monetary policy record is mixed. Throughout Draghi’s term, the ECB did not act pre-emptively when the economic outlook worsened. Instead, additional monetary stimulus was only decided upon when economic circumstances made more stimulus almost inevitable. The reaction of the stock market – a good indicator of how monetary policy is perceived by investors – has usually been negative after ECB rate cuts, signalling that the Bank did too little too late. Central banks need to act decisively and cut rates early when fighting a recession, especially when they are close to the ‘zero lower bound’ (interest rates cannot go much below zero). Draghi's ECB often decided to wait and ‘keep its powder dry’ – a strangely popular view among commentators and policy-makers that has no backing in economic research.

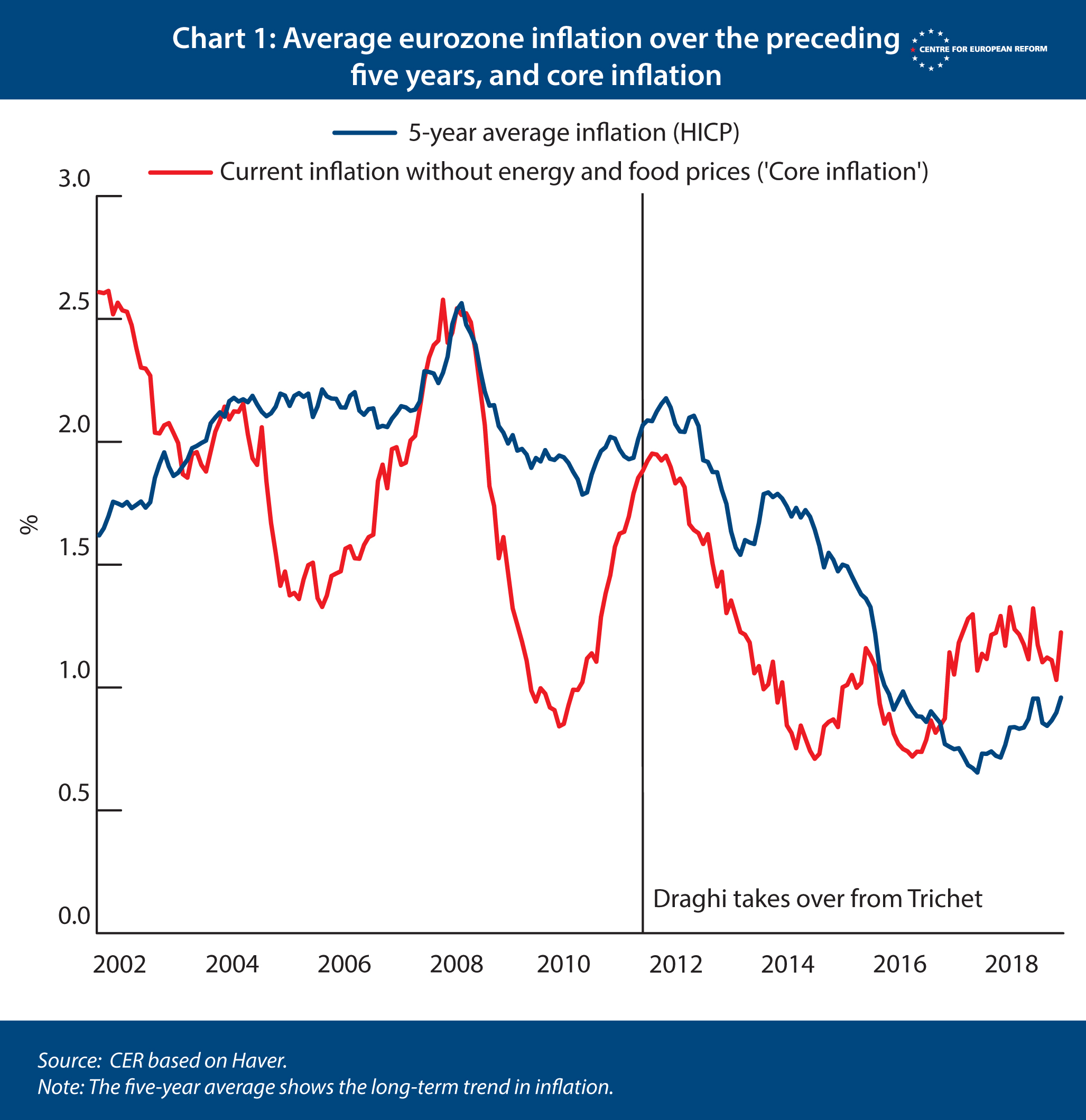

The result of Draghi’s monetary policy can be seen in Chart 1: average inflation, which should be around 2 per cent, now stands at a dismal 1 per cent, and inflation expectations are falling again. Core inflation, which strips out volatile food and energy prices, started falling from the time he took office. Even the ECB’s own estimates, which have been consistently over-optimistic, do not forecast that inflation will hit 2 per cent any time soon. There is no other way to put it: under Draghi, the ECB has failed to fulfil its mandate.

Which tools does the ECB have to fight the next crisis?

The eurozone will probably enter the next recession with inflation considerably below target, with little-to-no room to cut interest rates to stimulate the economy. In the deep recessions after the dotcom bubble burst in 2001 and the financial crisis of 2008, the ECB cut rates by 2.25 and 3.25 percentage points respectively. Such cuts are impossible today.

The ECB’s asset purchases – for example of government bonds, corporate bonds, or even equity – act as a stimulus when further rate cuts are impossible. They are intended to push down long-term interest rates. The problem is that long-term interest rates are already very low (Germany’s 10-year government bond yield, the benchmark for the eurozone, is currently at zero). What is more, through its QE programme, the ECB has already bought €2 trillion of public debt, roughly 21 per cent of the consolidated debt stock of eurozone governments. Another large-scale asset purchase programme would approach the legal and political limits of how much public debt the ECB should own, considering that the ECB is not allowed to finance governments directly.

There are a few remaining options. One is to expand an existing programme called targeted longer-term refinancing operations (TLTROs), which subsidises bank lending to the economy at negative interest rates. Another is much stronger ‘forward guidance’. The ECB would commit to keeping interest rates lower for longer than would otherwise be the case – letting inflation overshoot the target in the process, to reach an average of 2 per cent inflation (‘price-level target’). Such overshooting can only happen if the economy is doing very well and the labour market is tight enough to allow workers to demand higher wages. That means investors, firms and consumers would expect more demand and higher incomes in the future, affecting their spending and investment decisions now. What is clear is that providing meaningful monetary stimulus would require more creativity and bolder action than has so far been on offer, to get the eurozone out of the next recession.

Even with bolder action, the ECB may not be able to effectively stimulate the economy on its own. Fiscal policy needs to play a larger role than the eurozone’s fiscal rules currently allow. The ECB is not directly responsible for fiscal policies but does help shape the European economic discourse (which will have to change if fiscal policy is to help the ECB to meet its inflation target). Under Draghi, the ECB was fiscally conservative, calling again and again for fiscal consolidation in the eurozone, despite the detrimental effects on growth. Only in August 2013, when the eurozone was already deep in recession and inflation was falling fast, did the ECB change its language to call for “growth-friendly” fiscal consolidation. The next ECB president should forcefully make the case that fiscal policy has to support monetary policy in the next downturn.

The biggest challenge for the eurozone and the next ECB president would be a major political and economic crisis in Italy.

The biggest challenge for the eurozone and the next ECB president would be a major political and economic crisis in Italy. The country’s debt is sustainable only with favourable interest rates and economic growth. Worryingly, the difference between the Italian and German ten-year government bond yield (the ‘spread’) has increased from 1 per cent in early 2016 to 2.8 per cent today. Economic growth in Italy, meanwhile, is projected to come in at only 0.1 per cent in 2019. In a recession or a severe political crisis, markets might re-assess whether Italy’s debt is sustainable. Without a lender of last resort, there would be a run on Italian government debt, forcing the Italian government to seek help from the ESM. At that point, the politics of the eurozone would become highly acrimonious, as the ESM’s total lending capacity is only 18 per cent of Italy’s debt stock, and the conditions attached to an ESM programme would be very tough indeed. Therefore, the next ECB president would need to do his utmost to preserve the credibility of the Draghi promise “to do whatever it takes”, in order to prevent a run on Italian bonds.

The case against Weidmann

Champions of Jens Weidmann say that a German will win more German support for more monetary or fiscal stimulus, and the ECB’s role as a lender of last resort. (This ‘Nixon goes to China’ argument is also the reason many German conservatives do not support Weidmann.) But the downsides of a Weidmann presidency outweigh these benefits.

First, Weidmann not only opposed the OMT programme in the ECB governing council, he also testified against it in the German constitutional court (in person and with a detailed written statement by the Bundesbank). Essentially, the Bundesbank view was that it is not the job of the ECB to act as lender of last resort to governments. Differences in interest rates between countries could well be justified, for example if a country has a high debt stock and low growth. And in any case, it was hard – if not impossible – to distinguish unjustified divergences in interest rates from justified ones. But even if such differences in interest rates were unjustified, it was unclear whether monetary authorities should correct them. The Bundesbank also denied that it was the job of the ECB to prevent countries from being forced out of the eurozone.

President Weidmann would immediately face questions on whether “whatever it takes” still stands. It is true the ECB president is not all-powerful: the legitimacy of OMT is founded upon consensus in the ECB’s governing council; the tacit approval of Germany and France; and the ruling of the European Court of Justice upholding the programme’s legality. But there is a risk that OMT might unravel without the ECB president’s full support.

The main purpose of OMT has been to remove doubts about the viability of Italian membership. It worked without a cent being spent because enough people believed it. If a Weidmann presidency creates enough doubt about whether the OMT programme will be activated in a crisis in Italy, interest rates on Italian debt may become too high for Italian debt to be sustainable. In that case, the ECB would be called upon to prove its commitment to act as Italy’s lender of last resort. Eurozone governments should remember that once the credibility of a promise is in doubt, it is very costly to restore it.

The second downside of a Weidmann presidency is that it will not make the ECB more activist in fighting the next recession, and under him, the bank is less likely to call for fiscal support. Draghi’s ECB was too slow and reactive, and has brought the eurozone halfway to a situation like that in Japan (where inflation and interest rates have practically been at zero since the mid-1990s). Weidmann at times thought that ECB action was going too far. Through his opposition, he undermined the success of these policies, because dissenting members of the ECB’s council can weaken the impact of monetary policy by sowing doubt over the bank’s future policies. He is less outspoken now than he was in the past, but his views have not changed.

The president does not set policy alone, of course. In extremis, the president could even be outvoted, as was the case at the Swedish Riksbank in 2014. But it is hard to argue that the president does not matter for the overall direction of monetary policy. If that were true, then Draghi would not have mattered either.

Finally, Germany is already dominant in eurozone policy-making: the ECB was built on the model of the Bundesbank (though it has changed since); fiscal rules were tightened at Germany’s request during the crisis; Germany has a de facto veto on using the ESM (which is headed by a German, Klaus Regling); and further reforms to the institutions of the eurozone, such as unemployment ‘reinsurance’, common bank deposit insurance or a counter-cyclical eurozone budget, are in part blocked because Germany is opposed – or is at least not helping to convince other governments that are opposed. Nor should policy-makers reinforce the impression in some parts of Europe that the eurozone is run for and by German interests. Angela Merkel, the German chancellor, is acutely aware of such political sensitivities and unlikely to push for Weidmann as the next ECB president. And economically, she is right: the eurozone cannot be run using German fiscal and monetary policy at the same time. One has to give.

Christian Odendahl is chief economist at the Centre for European Reform.

Add new comment