The Greek bailout deal resolves nothing

Even if the new bailout makes it through the Greek parliament in coming weeks, the programme's economic incoherence will make it fall apart.

Before the bailout deal was struck, the Greek impasse had descended into point-scoring and finger-pointing, with creditors blaming Greece for the country’s economic woes, and Greeks – and the centre-left in other countries – blaming the creditors for insisting on more austerity and trying to humiliate the country. Now that a deal has been struck, the argument will shift onto whether Alexis Tsipras, with his confrontational bargaining strategy, has won anything that a more emollient government would not. Tspiras and his supporters claim that debt relief and a long-term programme of fresh lending would not have been on the table without playing hardball. But the truth is that Greece capitulated on Monday July 13th, not the creditors, and this has important ramifications for the bailout’s success.

Germany’s strategy is clear: impose harsh conditions on any government that seeks to change the austere rules of the game, knowing that electorates in Greece and elsewhere are terrified of the leap into the unknown that would be exit from the euro. Germany’s finance minister, Wolfgang Schäuble, demanded that Greece temporarily leave the eurozone, a move which would almost certainly have become permanent, and which would have resulted in severe short-term economic disruption. Germany later demanded European control over privatisations, whose assets would be put into an escrow account in Luxembourg, so that their contribution to paying back any bailout would be supervised by creditors.

Neither of these two demands were met, but they were intended to act as tough opening offers that would be jettisoned when Greece capitulated on all other fronts. The new bailout will consist of €82-86 billion of loan, according to the euro summit statement. In exchange, Greece will probably have to achieve a primary budget surplus (a surplus before debt service is deducted) of 1 per cent this year, rising to 3.5 per cent by 2018, according to the latest Greek proposals. VAT increases and pension cuts must start immediately, and the legislative process to pass a raft of other structural reforms must begin this week, under the close watch of creditor officials, for the negotiation on the final agreement to start. Privatised assets will remain in Greece, with the Greek government nominally in control, but their sale will be managed by creditors’ officials.

In a blog post on July 9th, IMF chief economist Olivier Blanchard claimed that Greece’s previous two bailouts failed not because the IMF miscalculated the impact of austerity on growth. Rather he argued that “fiscal consolidation explains only a fraction of the output decline.” The true problem in his view was insufficient structural reform and the persistent risk of Grexit, which had hit investment. While it is true that the persistent threat of exit harms investment, the broader point is that demand – investment, consumption and exports – matters for near-term growth. And public spending is an important part of demand.

The agreed structural reforms, while broadly in line with what Greece needs, will make little difference over the short term unless they are accompanied by stronger demand. The agreed fiscal consolidation will reduce demand, and thus fiscal policy will destroy the bailout’s chances of success.

Since austerity began in 2009, Greece has cut its ‘structural balance’ – the government balance with the effects of the economic cycle stripped out – by 21 percentage points of GDP, and output fell by 20 per cent, which suggests a one-for-one impact of austerity on GDP. Olivier Blanchard himself estimated the relationship to be between -0.9 and -1.7 in 2012. Before the bailout talks broke down and capital controls were imposed, the European Commission forecast a primary surplus of 2.1 per cent in 2015. But political uncertainty, the closure of banks, and capital controls will have resulted in a renewed plunge in economic activity. Even in the last quarter of 2014 and the first quarter of 2015, which were comparatively politically stable, the Greek economy was back in recession. If we generously assume that the Greek primary balance will be zero this year, Greece will have to raise the primary balance by 3.5 percentage points of GDP over three years. If we use Blanchard’s estimates, the austerity required will reduce GDP cumulatively by between 3.2 and 6 per cent. A government that foolishly claimed to be ending austerity will now be forced to do the opposite, lowering GDP, raising unemployment, emboldening radicals and fostering further political instability.

Moreover, a fresh round of consolidation will raise the Greek debt-GDP ratio, not lower it. The reason is that the harmful effects of fiscal consolidation in an economic downturn outweigh the benefits of lowered state spending. ‘Confidence’ effects, by which austerity advocates claim that business investment rises because investors support fiscal hawkishness, have not been much in evidence so far. And they will in any case be swamped by the continued uncertainty over Greece’s euro membership.

The IMF, in its latest preliminary debt sustainability analysis (DSA), assumes growth rates of zero per cent in 2015, and two per cent in 2016. This is despite the need to reach a primary surplus of one per cent this year, and two per cent next, which will reduce growth. And Greece does not currently have a functioning banking system. With a primary surplus of around zero at the moment (the current positive figures mainly stem from running up government arrears), Greece would need to implement fiscal adjustments of at least 1.5 per cent, which would contract the economy by at least another 1.5 per cent, and this adjustment will have to be repeated in 2016. The only hope is that the Greek economy will return to growth. But that growth rate, if we strip out the effects of fiscal policy upon GDP, would have to be above 1.5 per cent in 2015 and above 3.5 per cent in 2016 for the assumptions in the IMF’s current projections, which already foresee mild debt restructuring, to be fulfilled. Under more realistic economic assumptions, the rest of the eurozone will have to consider a high level of debt relief, or they could simply demand more austerity, which is likely.

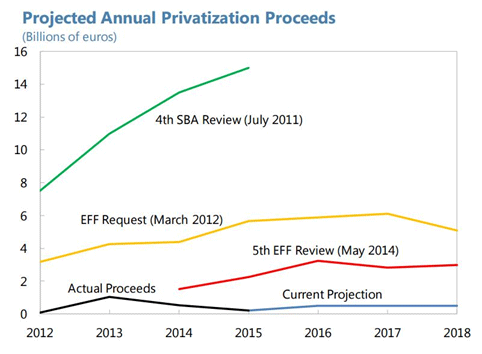

The creditors forecast that revenues from privatisation will amount to €50 billion over the course of the loan programme. This is hopelessly optimistic, given how wrong the troika’s previous forecasts were (see chart, taken from the IMF’s DSA). The current projection, shown by the blue line, is that they will raise less than €1 billion a year. Even the troika’s more optimistic forecasts, from April 2014, only predicted revenues of €22.3 billion until 2020.

There is one positive move in the new privatisation arrangements: Greece will have to make fewer ‘fire-sales’ of public assets to plug short term funding gaps. The length of the new programme means that they may be able to delay some sales. What is more, Greece is encouraged to support privatisations, as one-quarter of the revenues will be used for investment in Greece.

But will Tsipras be able to push the tough reforms and adjustment agenda through the Greek parliament? The main opposition parties – ND, PASOK and To Potami – have already signalled their support, and the rebellion within Syriza seems to be too small to threaten a blockade. But it is hard to see how Tsipras can push through the agenda without presiding over a split of his party. The creditors may hope that the Syriza government collapses, and a national unity government replaces it. But Tsipras still enjoys broad public support, and he may end up leading it.

The lack of trust between the government of Greece and the creditors over the implementation of reforms and adjustment has been a key stumbling block over the course of these latest negotiations – and there is plenty of blame to spread around. The institutions are trying to dispense with trust, by demanding reform commitments before money is disbursed (so-called prior actions) and insisting on stricter supervision by creditor officials. Both are unlikely to work. As the IMF has found out in its own programmes around the world, prior actions do not guarantee implementation beyond superficial legislation, if governments do not really support them. Crucially, without growth, political support for reforms will diminish further.

Greece’s third bailout is bound to fail for the same reasons that the last two programmes did.

Greece's third bailout is bound to fail for the same reasons that the last two programmes did. Even if Tsipras can survive, and fresh elections do not lead to a more radical government in the short term, the bailout’s economic incoherence will lead the agreement to unravel eventually. Greeks will then have ceded further economic sovereignty to creditors who they despise, who seek to pin the blame on the Greek government for the failure of past programmes to generate growth, and who have only marginally adjusted the failed strategy. When the mooted structural reforms fail to lead to recovery, which they will because fiscal policy is pushing the other way, the agreement will fall apart. Grexit is still very much on the table.

Christian Odendahl is chief economist and John Springford is a senior research fellow at the Centre for European Reform.

"This piece was amended to reflect that the upper range Blanchard’s estimates would suggest a GDP reduction of 6 per cent, not the 4.25 per cent in the original version."