The EU's carbon border adjustment mechanism: How to make it work for developing countries

- The EU’s proposed carbon border adjustment mechanism (CBAM) risks unfairly penalising the exports of developing countries. If the mechanism applied to the imports of all goods currently covered by the EU’s Emissions Trading System, up to $16 billion of developing country exports to the EU could face an additional charge.

- The EU already uses the WTO’s so-called enabling clause to grant some developing countries preferential access to its market unilaterally. The EU should fully or partially exempt those countries’ exports from its CBAM on a similar basis.

- Exports from the 46 least developed countries are covered by the EU’s ‘Everything But Arms’ scheme, and enjoy duty and quota-free access to the EU market. They should be fully exempt from the EU’s CBAM

- Exports from 23 lower-middle-income countries are covered by the EU’s Generalised System of Preferences (GSP and GSP+) schemes, and benefit from conditional (and partial) preferential access to the EU. They should be exempted from the CBAM up to a pre-determined threshold.

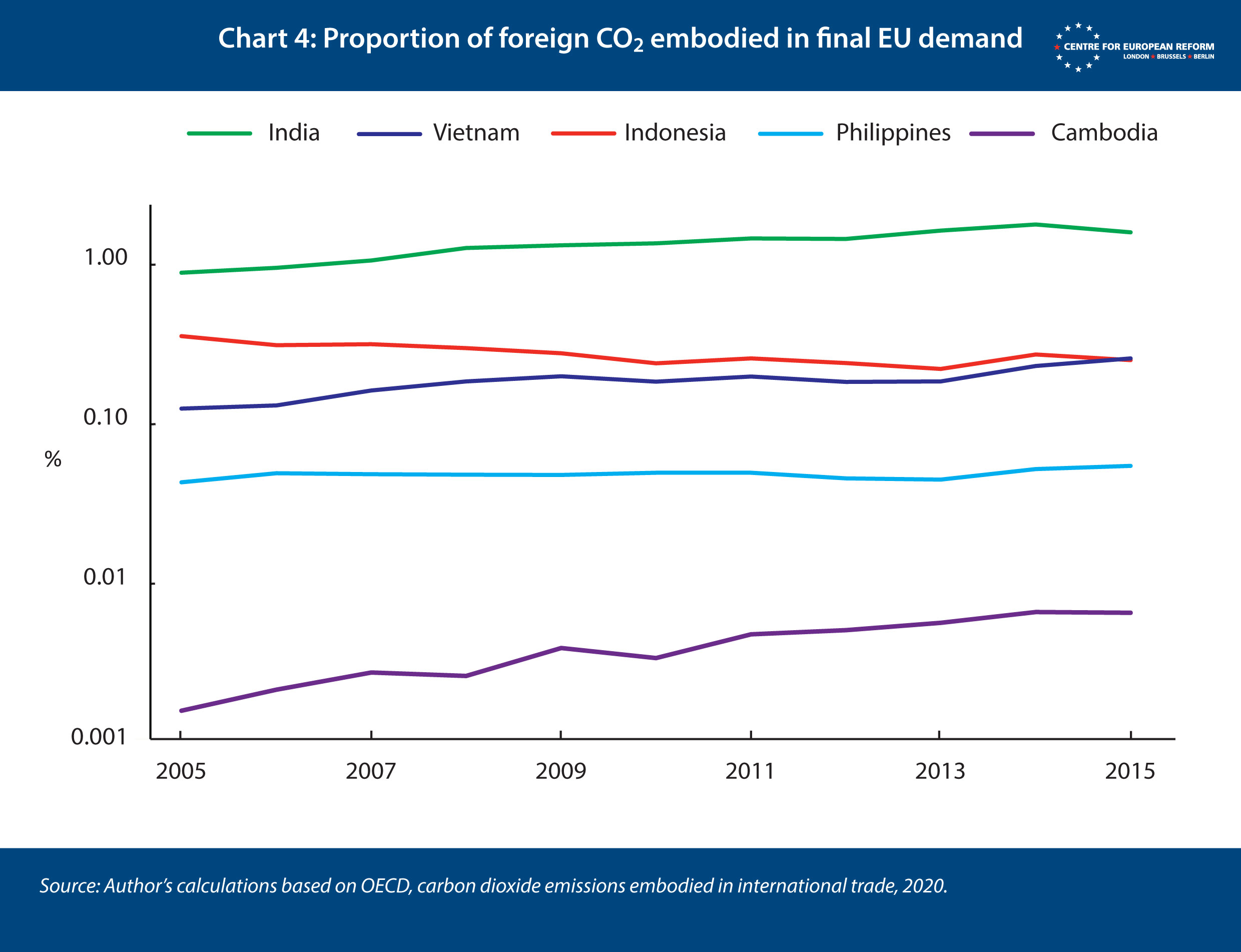

- Exempting developing countries’ exports from the CBAM would not materially undermine the EU’s carbon reduction efforts. CO2 imported from developing countries accounts for only a small proportion of the CO2 embodied in final EU demand – imported CO2 from India, for example, accounts for just over 1 per cent.

- To guard against carbon leakage, whereby carbon-intensive production shifts to low-income countries in order to avoid the EU’s CBAM, the EU should design safeguard provisions that could be triggered in the event of a surge in imports from an exempt country.

- Developing countries would not be discouraged from decarbonising their economies. The CBAM exemptions would be temporary and linked to levels of development. As developing countries’ economies grow, or their exporters become more internationally competitive, they will graduate out of the exemptions. Their exports will then be subject to EU’s CBAM unless they have an equivalent domestic carbon price, or the goods are produced with greater carbon efficiency than EU equivalents.

The EU intends to introduce a carbon border adjustment mechanism (CBAM) by the end of 2021. While the exact design is not yet known, the CBAM would see a charge levied at the border, proportionate to the carbon emitted during the production of imported goods. From the EU’s perspective, a CBAM is necessary to ensure that its efforts to combat climate change are effective: that is, they do not result in carbon leakage, as energy-intensive industries relocate outside the EU’s regulatory jurisdiction and European production is outcompeted by cheaper, carbon-intensive imports.

However, the EU’s proposed CBAM risks unfairly penalising the exports of developing countries. While all countries should accept responsibility for tackling a shared global threat such as climate change, it is unreasonable to expect poorer countries to shoulder the same burden as those that are richer and have historically contributed a larger share of cumulative carbon emissions. This principle, termed ‘common but differentiated responsibilities and respective capabilities’, has guided the international climate negotiations so far. Under the Paris Agreement, for example, a country’s national circumstances can be taken into account when making its climate commitments. Furthermore, concerns about the CBAM’s impact on developing countries have already been raised in the WTO’s market access committee – with a particular focus on the EU’s public framing of its CBAM as a revenue raising tool, and a contributor towards the EU’s ‘own resources’ (as the EU institutions’ revenues are called), rather than as a means of addressing climate change.1

It is unreasonable to expect poorer countries to shoulder the same burden as those that are richer.

The EU’s CBAM must be designed with developing countries in mind. Goods imported into the EU from the 46 least developed countries (LDCs), as defined by the UN, should be exempt from any CBAM levy.2 Such an approach would complement the EU’s existing unilateral preference scheme for LDCs, which offers duty and quota-free access to all goods imported from LDCs other than weapons – the ‘Everything But Arms’ (EBA) scheme. Excluding LDCs from the CBAM should not prove controversial with member-states, and is consistent with existing EU approaches to trade, as well as the EU’s broader development objectives.

For lower-middle-income countries such as India, Indonesia and Nigeria, which are much bigger contributors to global carbon emissions, the EU faces a tougher decision. Here the EU should build its approach on its existing unilateral preference schemes covering select lower-middle income countries: the standard Generalised Scheme of Preferences (GSP), which fully or partially removes tariffs on two-thirds of tariff lines; and GSP+, which offers additional trade benefits to economically vulnerable countries if they implement 27 international conventions relating to the environment, human rights, labour rights and good governance. In line with existing GSP and GSP+ conditions, imported goods could be exempted from the EU’s CBAM only until they account for a significant share of the EU’s total imports. This would avoid penalising nascent industries in lower-middle-income countries, while ensuring that sectors that are already internationally competitive are treated as such.

The exemptions proposed in this paper should not compromise the CBAM’s raison d’être. Emissions from developing countries account for a small proportion of the embodied in final EU demand. As such, exempting their exporters from the CBAM would not undermine the EU’s attempts to prevent carbon leakage. Equally, even with exemptions, developing countries will still have incentives to transition away from polluting energy sources and processes. As countries and industries develop, they will graduate from exemptions. They would then have two options to remain exempt from the CBAM: either governments could put in place their own internal carbon pricing scheme, equivalent to the EU’s; or industries could use more carbon-efficient means of production than for equivalent goods made in the EU.

This policy brief will explore:

- the rationale behind the EU’s efforts to introduce a CBAM, and how it will most probably operate in practice;

- why an EU CBAM could pose a risk to developing countries;

- how best to design an EU CBAM so as to account for developing country concerns; and

- some of the arguments against exempting developing countries from an EU CBAM.

Why is the EU pursuing a CBAM?

The European Commission intends to table proposals outlining what an EU CBAM could look like by the second quarter of 2021.3 The CBAM will form part of a broader package of EU measures called the European Green Deal, designed to help the EU become carbon neutral by 2050. More specifically, the CBAM is being introduced to reduce the risk of ‘carbon leakage’ – when companies move production from jurisdictions with strict emission regimes to those with weaker ones – to produce goods more cheaply. If the EU’s climate measures do not manage the risks of carbon leakage, they could lead to the EU’s emissions largely moving elsewhere rather than being reduced.

A CBAM is necessary to ensure that the member-states that host heavy industry continue to support the EU’s broader climate goals.

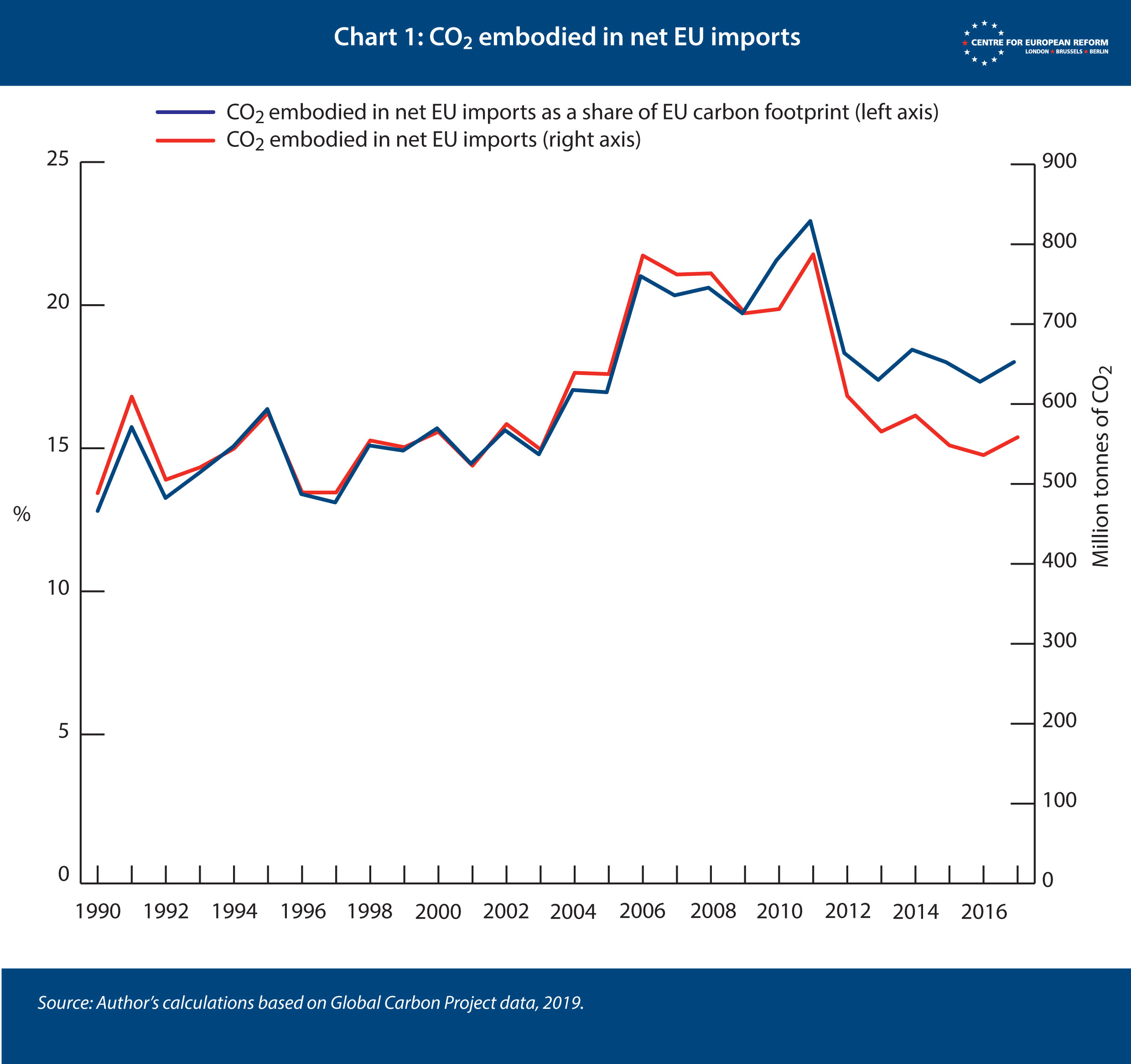

There is little evidence that carbon leakage has increased in recent years, despite the introduction of measures such as the Emissions Trading System (ETS). Chart 1 shows that the total amount of CO2 embodied in EU net imports, and the proportion of imported CO2 as a share of the EU’s total carbon footprint, is similar in 2017 to 2005, when the ETS was introduced. However, it is conceivable that carbon leakage could become an issue in the future, if the EU’s actions to combat climate change lead to a significant increase in its effective internal carbon price compared to those of its trading partners. And from a political perspective, perception matters: if the fight against climate change is seen as overburdening European industries or putting jobs at risk, political support for it will fall. A CBAM is necessary to ensure that the member-states that host heavy industry continue to support the EU’s broader climate goals.4 As a supplementary benefit, a CBAM could also discourage free-riding, and provide an incentive for countries that rely on the EU as an export market to introduce their own carbon pricing mechanisms.

However, the EU discussion has so far been mostly inward-looking. Beyond general statements regarding the need to ensure the CBAM does not unduly impact developing countries, policy-makers and European politicians have given little thought to the potential wider consequences of an EU CBAM. In order to minimise the risk of future trade disputes, and ensure that the CBAM does not damage the EU’s international relationships and undermine its development agenda, this must change.

How would an EU CBAM work in practice?

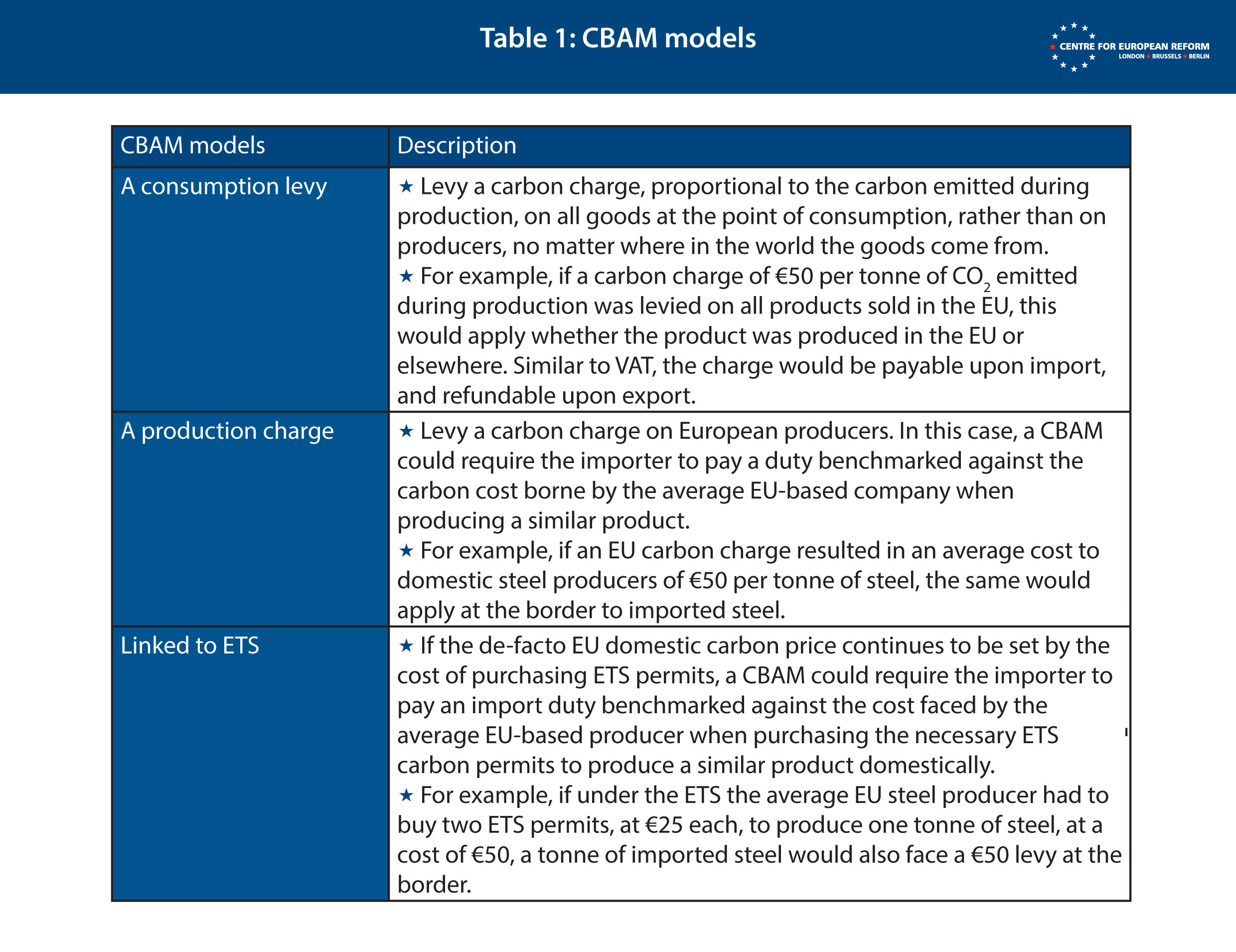

At the time of writing, the exact design of the EU’s proposed CBAM remains unknown. There are different possible models (see Table 1) – with a CBAM linked to the ETS being the most probable outcome. But irrespective of the exact approach, the CBAM will need to conform to some set principles if it is to be compatible with the EU’s World Trade Organisation (WTO) commitments.

To be consistent with the EU’s WTO commitments, and legally defensible, the EU’s CBAM can only apply to sectors which are also subject to an internal EU carbon price. In practice, at least initially, this domestic price will probably be set by the cost for domestic producers purchasing CO2 permits through the EU’s ETS. This constraint would limit the CBAM’s scope to sectors currently covered by the ETS – energy-intensive industries including oil refineries, steel and metal works, cement, paper, and some basic chemicals. It would prevent the EU from including agriculture in the CBAM, for example. But the scope could expand if the EU develops further internal CO2 pricing mechanisms or extends the coverage of the ETS to new sectors, as is currently under discussion in a review of the ETS.

To be legally defensible, the EU’s CBAM can only apply to sectors which are also subject to an internal EU carbon price.

For third countries exporting to the EU, beyond sectoral coverage of the CBAM, the exemptions matter, too: under what circumstances would imported goods not be subject to an EU CBAM levy, despite falling under the sectoral coverage of the scheme? Here there will probably be two routes available:

1. Countries that have a similar domestic carbon price to the EU could be granted equivalence, meaning that exports originating in their territory would not be subject to the EU’s CBAM, so as to avoid double carbon taxation. Partial equivalence is also a possibility – countries which have an internal carbon price, but set lower than the EU’s, could see their exports to the EU benefiting from a reduced CBAM levy.

To reduce the risk of international opposition and potential countermeasures, the EU has to ensure that the process for determining whether foreign carbon pricing regimes are equivalent to its own, and therefore exempt from the CBAM, is transparent and open to scrutiny. The equivalence process should also focus explicitly on whether regimes achieve the same outcomes. If another country can demonstrate that producers within its jurisdiction are subject to climate policies that are similar in effect to the EU’s carbon price, the precise design of its scheme should not matter. The EU should also allow countries to appeal against its decisions via an independent arbitration process.

There is a risk, however, that equivalence becomes politicised and used as leverage to serve unrelated EU policy objectives, rather than being a technocratic exercise. That has happened in the case of the equivalence process for financial services, where the EU has previously threatened to withdraw equivalence for Swiss stock exchanges in the hope it would lead to Swiss concessions in unrelated negotiations. Such politicisation must be avoided if the aim of the CBAM is to achieve its primary goal of contributing to a reduction in EU and global greenhouse gas emissions, and reduce the risk of countermeasures.

2. Imported goods that have been produced with fewer emissions than their EU equivalents could be subject to a proportionally reduced charge. For example, if an importer of ceramics could demonstrate that they had been produced using zero-carbon geothermal kilns, the imported ceramics would not face a CBAM charge even if they originated from a country without an equivalent domestic carbon price to the EU and ceramics were covered by the CBAM.

Calculating the quantity of carbon embedded within a given good, however, can be costly and difficult, particularly if the product contains a number of different inputs. For some importers, the cost of certifying the true carbon content of the product might be greater than the CBAM levy applied at the border. Here the EU should shoulder some of the cost for businesses, and SMEs in particular. It could, for example, create and fund third-party certification bodies able to provide an objective assessment of a product’s CO2 content. Such an approach would be particularly beneficial to exporters in developing countries, who may struggle to certify the carbon content otherwise.

Both equivalence and product-specific exemptions could help developing countries’ exporters, but in practice compliance with either could prove infeasible for many countries and companies, due to a lack of state and private sector capacity.

What is the risk to developing countries?

In theory, an EU CBAM could negatively impact the development of poorer countries, and reduce opportunities for export-led development. The Bank of Finland estimates that a CBAM of $28 per tonne of CO2 on imports is equivalent to an average import tariff of 2 per cent.5 Depending on the developing country’s export mix, the applied EU ‘tariff’ could be higher or lower – imports from India, for example, would face a 4 per cent tariff according to the study. As the carbon price increases, so would the effective tariff. The IMF estimates that a carbon price of around $75 per tonne of CO2 will need to be in place by 2030 if the rise in global temperatures is to remain below 2 degrees. That will require the effective carbon price in the EU to almost triple, implying an effective average applied CBAM tariff of around 6 per cent, barring a change in technology or policy in the exporting country.

Developing country exporters could face a significant barrier to trading with the EU. Most developing countries currently have tariff and quota free access to the EU market, as a result of EU unilateral preference schemes or economic partnership agreements. But an EU CBAM could dent this relative advantage if it applied to developing countries’ exports, but exempted many developed country exports, either because they originated from countries that had introduced their own equivalent domestic carbon price or because companies’ production processes were more carbon-efficient.

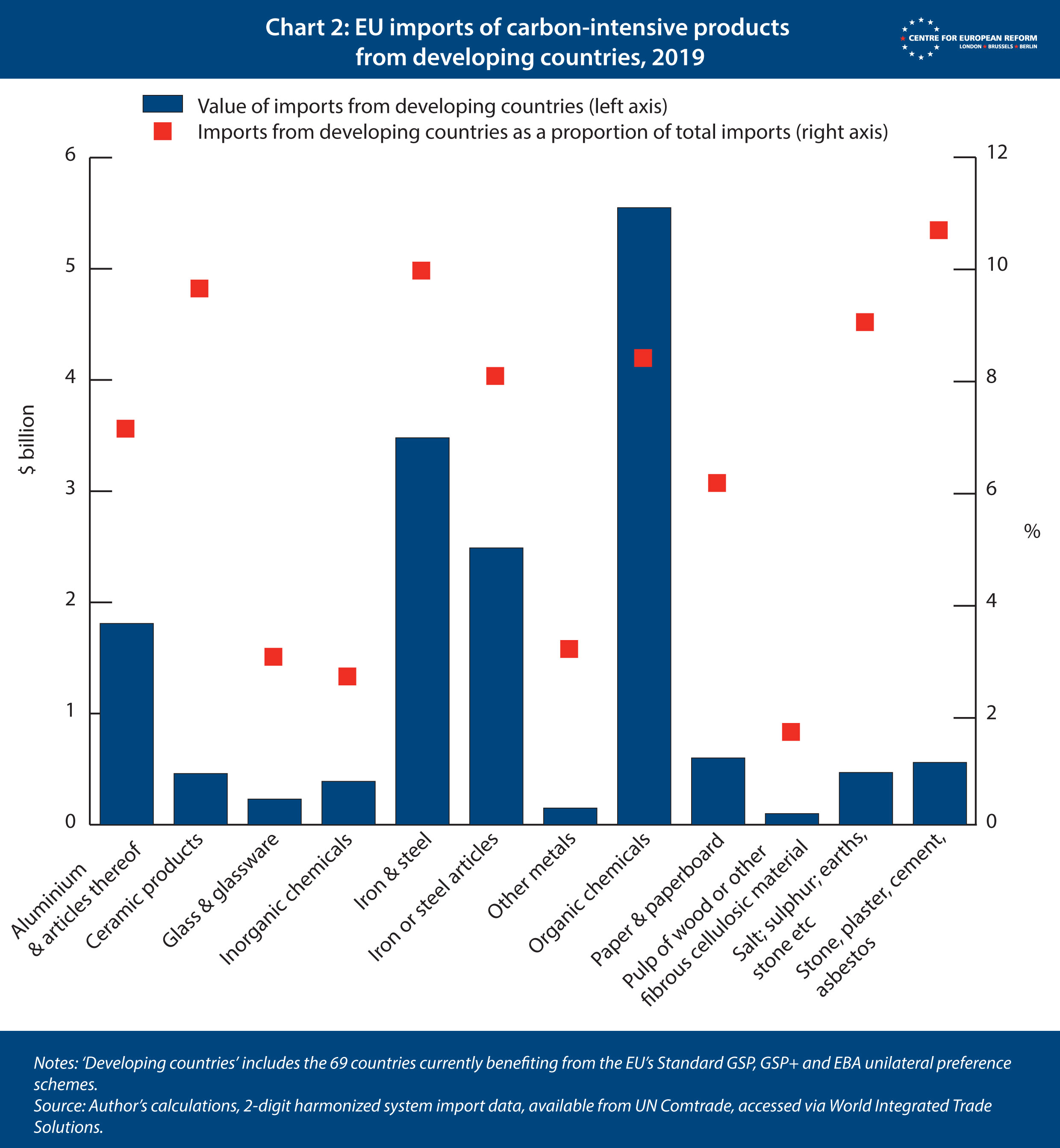

Assuming an EU CBAM initially only covers goods covered by its ETS, developing countries could see exports to the EU worth $16 billion subject to the new CBAM levy. Chart 2 shows the value of EU imports from developing countries for a range of goods that are currently covered by the ETS, as well as the share of total imports for each product type from developing countries. Exempting developing countries from the CBAM would not be particularly costly for the EU in the context of its total imports – of all the sectors covered, only imports of stone, plaster and cement from developing countries account for over 10 per cent of total imports (although other sectors such as iron and steel come close). However, for developing countries, additional CBAM-related costs could prove to be very damaging.

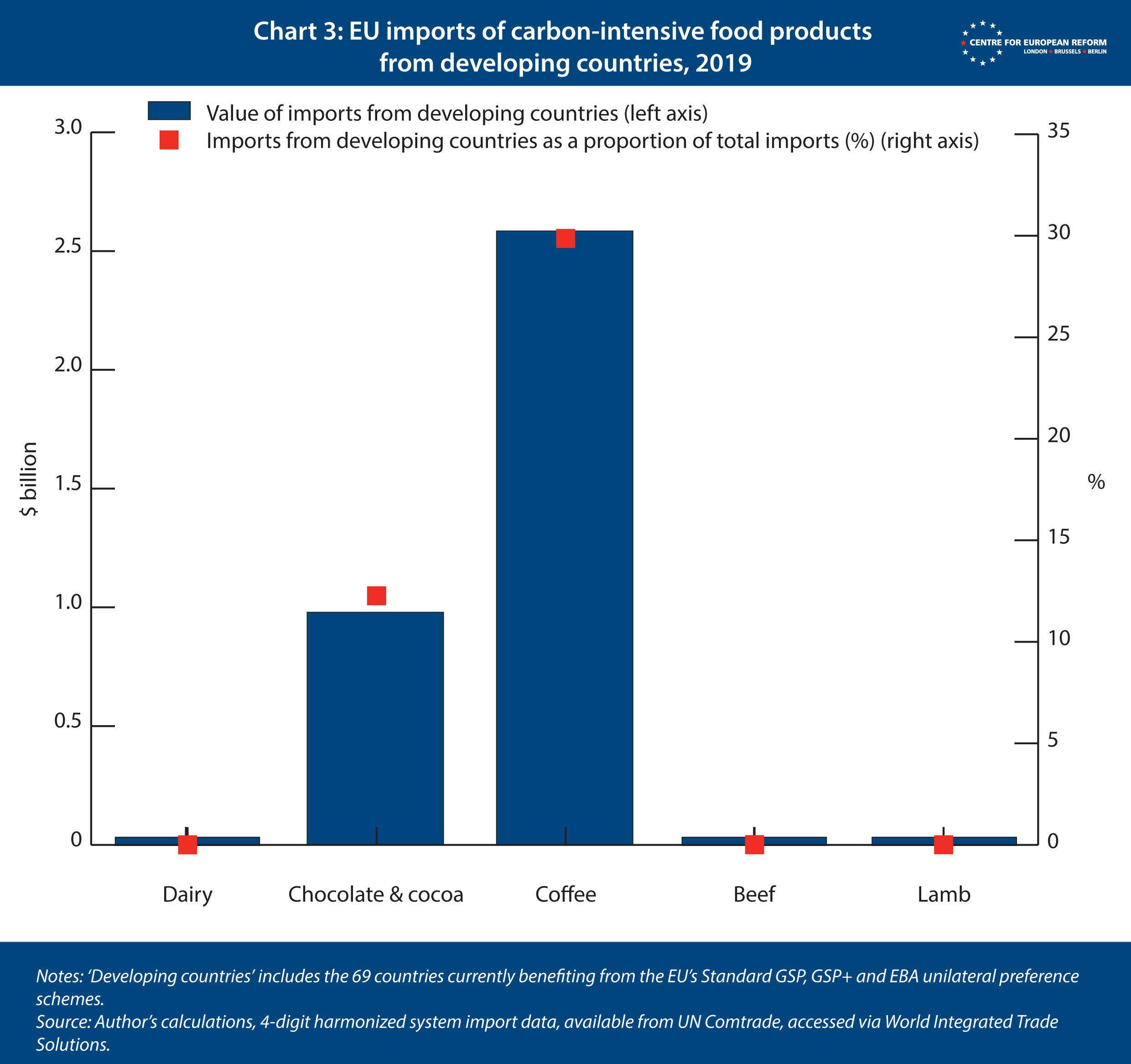

If the EU were to expand the CBAM to cover more sectors, as advocated by the European Parliament’s environment committee, developing countries could find themselves even more exposed to the CBAM.6 Were agricultural emissions to be targeted, for example, an additional $3.6 billion of developing country trade could be subject to the CBAM (Chart 3). But developing countries do not currently export much in the way of carbon-intensive food products such as beef and dairy to the EU, because they are unable to meet EU food safety standards – Vietnam was the only GSP beneficiary to export any beef to the EU in 2019.

Furthermore, CO2 imported from developing countries accounts for only a small proportion the CO2 embodied in final EU demand – for example, imported CO2 from India, the third largest carbon emitter in the world, only accounts for just over one per cent of the CO2 embodied in final EU demand (Chart 4). Of the countries covered by the EU’s unilateral preference schemes, the next largest sources of CO2 consumed in the EU, Indonesia and Vietnam, contribute around six times less than India.

How to accommodate developing countries

It is in the EU’s interest to ensure that a CBAM does not unfairly penalise developing country exporters. Subjecting these exporters to a CBAM could lead to the EU undermining the multilateral approach to climate mitigation, by compromising the notion of differentiated responsibilities and respective capabilities. Accommodating developing countries could also ensure that the CBAM does not come into conflict with the EU’s development objectives.

From a legal perspective, there is a precedent for discriminating in favour of developing countries.

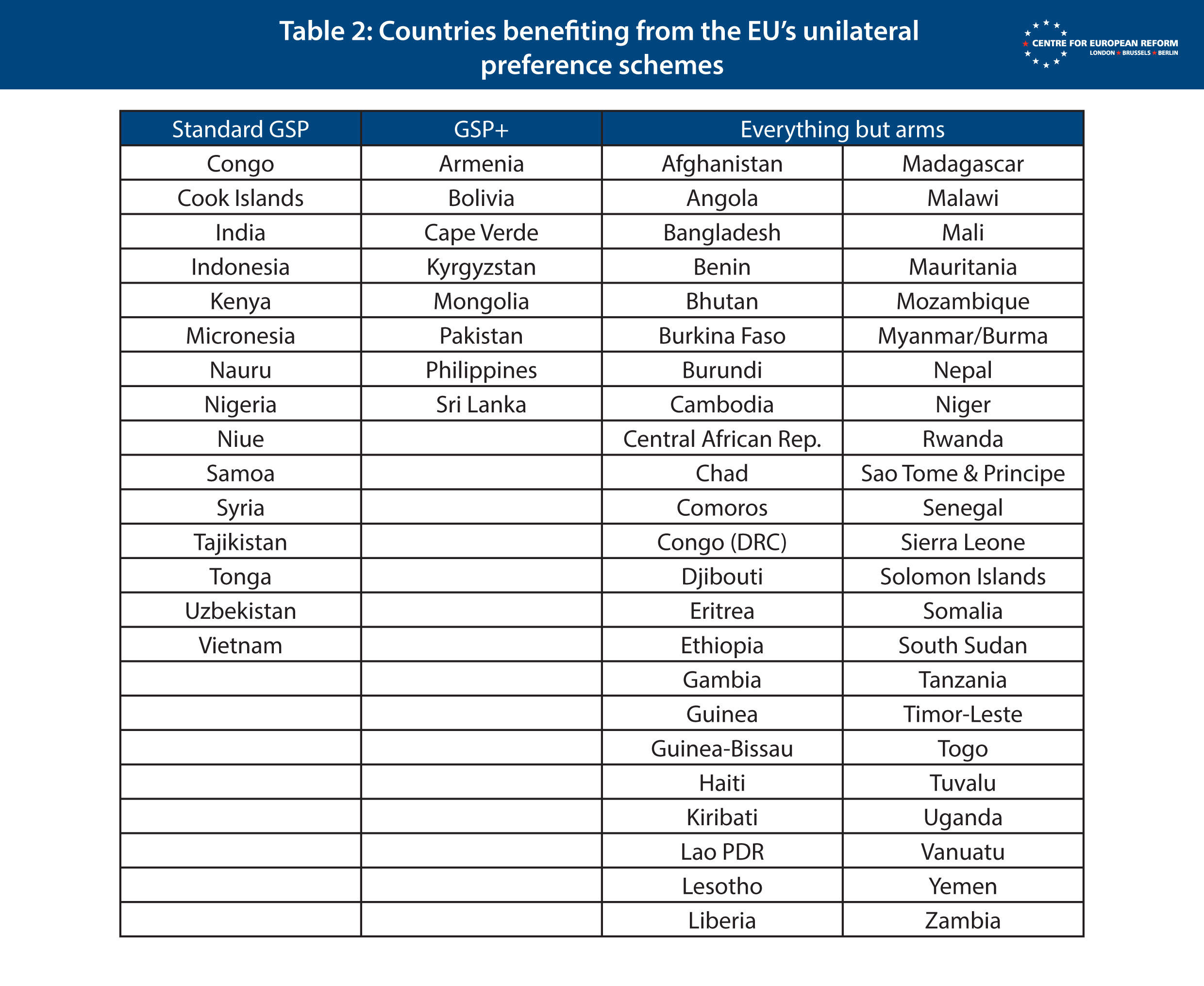

From a legal perspective, there is a precedent for discriminating in favour of developing countries. The EU already uses the flexibility afforded by the WTO General Agreement on Tariffs and Trade’s (GATT) so-called enabling clause to unilaterally grant developing countries preferential access to its market under its GSP schemes.

The EU could similarly justify the full or partial exemption of countries currently covered by its unilateral preference schemes (Table 2) from its CBAM. Here, as it does with its trade preferences, the EU should differentiate between LDCs and lower-middle-income countries – offering a full, unconditional exemption to the former, and conditional exemptions to the latter.

How to exclude LDCs from an EU CBAM

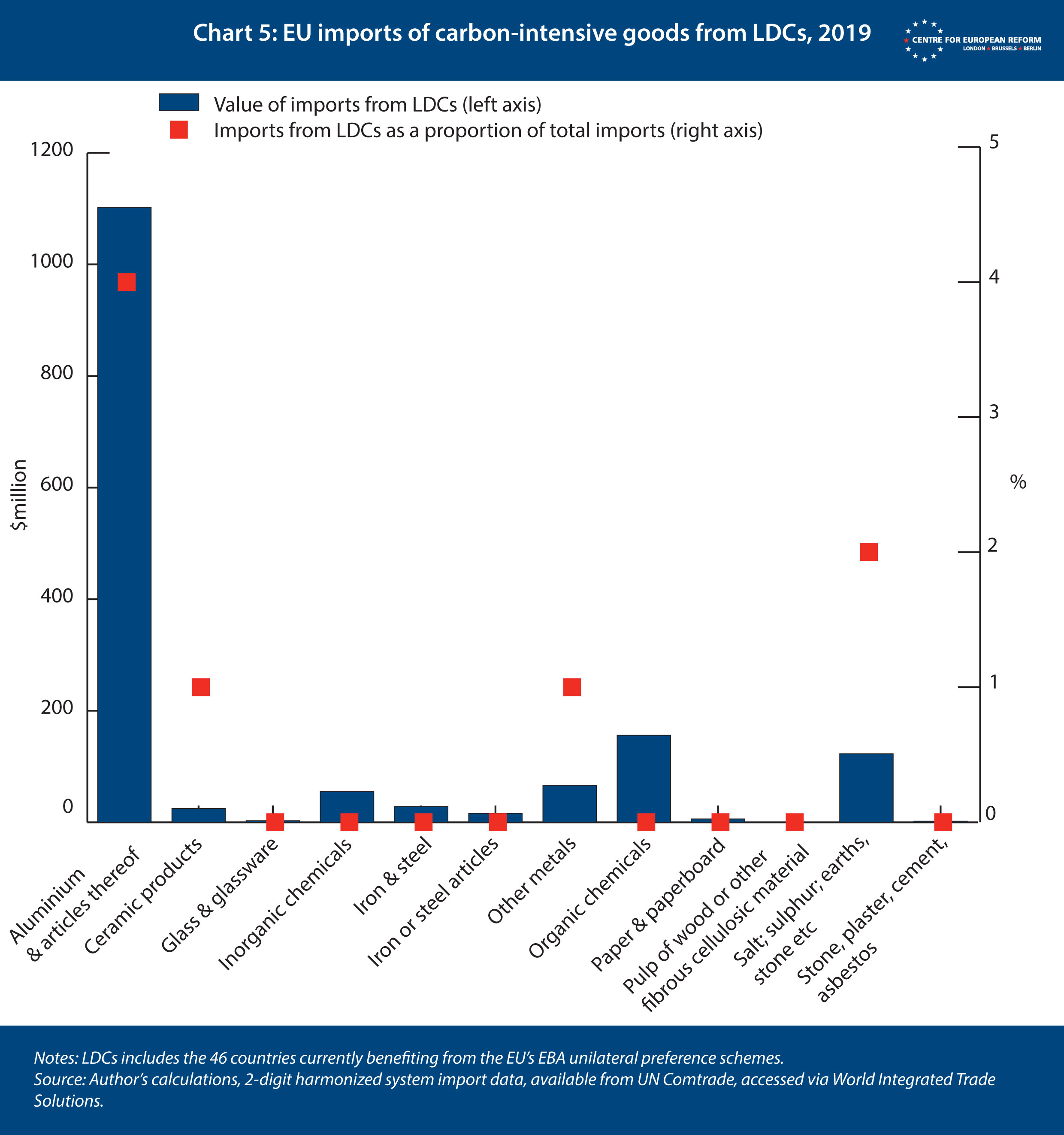

Goods originating from the 46 LDCs should be fully excluded from the EU CBAM to avoid penalising their exporters. From an EU perspective, the low volumes of LDC imports means there is little risk that a blanket exemption will encourage carbon leakage. Looking solely at EU imports of carbon-intensive goods from LDCs, Chart 5 shows that, as a proportion of total imports, only LDC imports of aluminium come close to being of any overall significance, at just under 5 per cent of the EU’s total aluminium imports.

How to exclude lower-middle-income countries from an EU CBAM

Lower-middle-income countries pose a different set of problems for the EU, as some of them are large net contributors to global greenhouse gas emissions, and host internationally competitive industries. A blanket CBAM exemption could discourage transition to lower-carbon production methods, but equally full application of the CBAM could unfairly penalise nascent industries in countries that are still in need of further development.

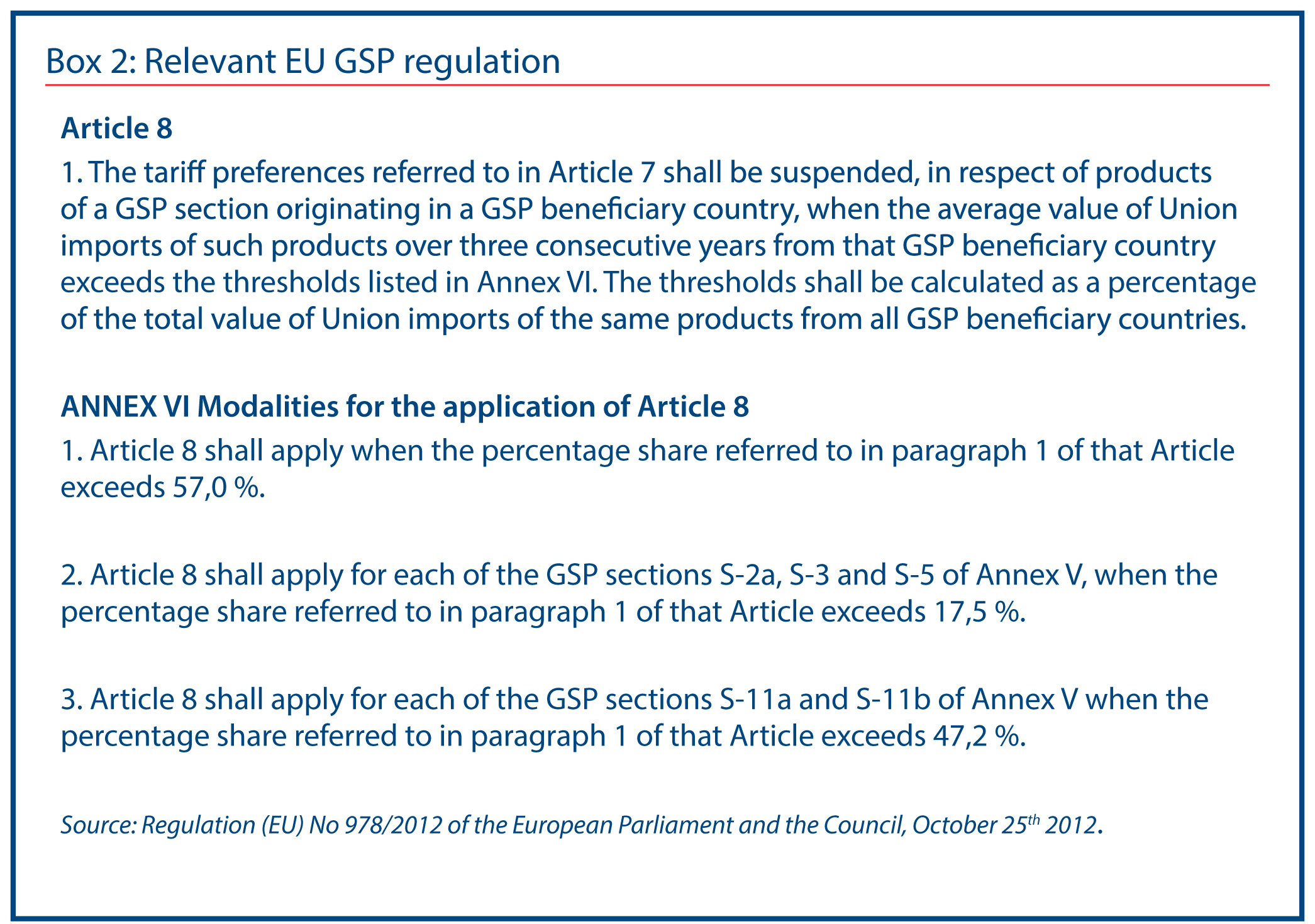

Here, the EU should exempt imports from countries benefiting from its standard GSP or GSP+ unilateral preference schemes, until imports of a product reach a threshold that indicates the sector is already developed and internationally competitive. For example, the GSP schemes currently only allow tariff-free access to the EU until the average value of imports of a specific product from a GSP beneficiary country exceeds a given threshold. The threshold is calculated as a percentage of the total value of EU imports of the same product from all GSP beneficiary countries – and is usually set at 57 per cent (see Box 2).

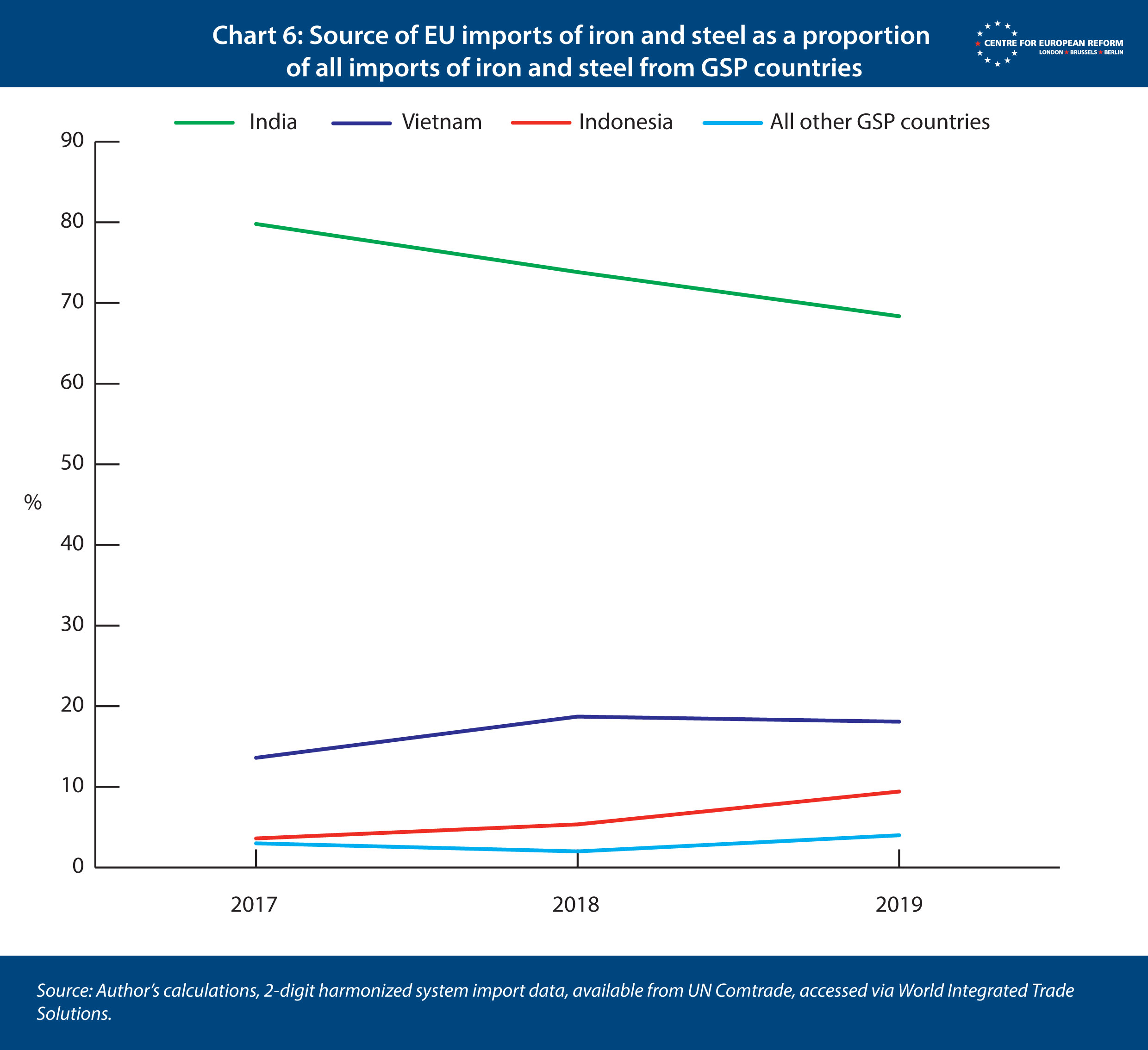

The EU could adopt a similar approach when deciding whether imports from standard GSP and GSP+ countries are exempt from its CBAM or not. This would mean that imports from GSP and GSP+ countries were exempt from the CBAM until the average value of EU imports of a given product exceeds 57 per cent of the total value of EU imports of the same product from all GSP beneficiary countries. Such an approach, for example, would see the CBAM levy apply to imports of Indian iron and steel, which accounts for well over 57 per cent of all iron and steel imported from GSP beneficiaries, but not to iron and steel imports from Indonesia, Vietnam and others (Chart 6). Alternatively, the EU could introduce a bespoke CBAM threshold with its own criteria.

Rules of origin

The ability to determine where an imported product originates from is central to any CBAM. Without origin requirements, goods could be produced in a country without an equivalent domestic carbon price to the EU and then shipped to the EU via a country with such a carbon price, to take advantage of the CBAM exemption. However, this issue can be addressed using existing measures, as rules determining the origin of specific imported goods matter in international trade regardless of carbon pricing. There are two existing EU approaches to assessing origin – preferential rules of origin which determine whether imports qualify for a trade agreement or unilateral preference scheme, and non-preferential rules of origin which are relied on when trading on the basis of the EU’s WTO commitments:

- The EU could rely on its existing GSP preferential rules of origin. If an import met the rules of origin requirement of the EBA, Standard GSP or GSP+ schemes, and therefore qualified for preferential tariffs when entering the EU, it would also be exempt from the CBAM. However, these rules of origin can be overly burdensome, leading to some exporters not taking advantage of the schemes. The last major (and slightly dated) EU review found that in 2016 the average uptake (on a country-by-country basis) of the preferential trading arrangements, or preference utilisation rate, for exports to the EU from countries covered by GSP schemes, was 56 per cent.7

- The EU could instead rely on its non-preferential rules of origin which come with a significantly reduced compliance burden.8 The advantage here is that all EU importers already have to comply with these – so it would not be an additional burden for developing country exporters. Moreover, the EU already uses non-preferential rules of origin to police anti-dumping measures.

In practice, the amount of developing country CO2 embedded in final EU demand is small enough to be considered immaterial.

Either way, the EU will need to be able to determine where imported goods come from.

Safeguards

In the unlikely event that imports from a developing country could be directly linked to carbon leakage, the EU can retain the right to trigger safeguard measures, and, for example, apply the CBAM levy to specific imports. Safeguard measures are not uncommon, and exist within the WTO framework, as well as in most trade agreements and the GSP regime. The EU recently imposed tariffs on rice from Cambodia and Myanmar, despite both countries being beneficiaries of the EBA scheme, because their low prices hurt EU producers (while benefitting EU consumers, of course).9

Concerns and considerations

There are arguments against providing exemptions for developing countries. Exemptions could undermine the EU’s legal rationale for a CBAM, leave the door open for carbon leakage and remove an incentive for policy-makers in the developing world to transition their economies away from high carbon energy sources, and carbon-intensive production methods. However, none of these arguments stand up to scrutiny.

CBAM legal basis

For the CBAM to be compatible with the EU’s WTO commitments, the EU will need to ensure that it does not discriminate against imported goods, and that the import levy is equivalent to the cost imposed on domestic industry by an internal tax or similar measure (as per GATT Article II.2 (a)). It should also be explicitly designed for the purpose of effectively reducing EU carbon emissions. This is to ensure that even if the CBAM is found to be discriminatory, it could still be justifiable under GATT’s environmental exception (Article XX (b) and (g)).

Exempting developing countries could undermine the environmental justification for the CBAM, if it led to a large amount of offshore emissions being ignored. However, in practice, the amount of developing country CO2 embedded in final EU demand is small enough to be considered immaterial. As Chart 4 demonstrates, the only country contributing more than one percentage point to CO2 embodied in final EU demand is India, and India’s most carbon intensive exports would probably be covered by the CBAM mechanism anyway, if applied according to the recommendations made in this paper.

Opportunities for carbon leakage

Exemptions could theoretically create new opportunities for carbon leakage, and reduce the political incentives for developing world governments to decarbonise their economies. However, again, this would not pose a problem in practice.

The exemptions proposed in this paper are only temporary, in that they would only apply unconditionally to the least developed countries, and conditionally to lower-middle income countries. As countries become richer, and their industries more internationally competitive, they will graduate out of these exemptions. As such, there is still an incentive for these countries to pursue low-carbon growth as well as the introduction of domestic carbon pricing instruments – in their absence their exports to the EU would be subject to its CBAM once the exemptions ceased to apply. The EU would also be able to trigger the CBAM’s safeguard mechanisms in the event that it experienced a surge in carbon intensive imports from an exempt country.

Conclusion

The EU has ambitious development and climate agendas. It is important that both are reflected when designing the CBAM. Ensuring that its CBAM does not undermine its broader development objectives, and takes into account the existing international principle of ‘common but differentiated responsibility’, should be a priority for the EU. From a more self-interested perspective, for the EU to include measures that address the concerns of developing countries would also reduce the risk of the CBAM facing legal challenges from aggrieved WTO members.

This paper suggests one potential solution, but exempting developing countries from the EU’s CBAM should not be considered in isolation. As well as CBAM exemptions, the EU must consider how else it can support decarbonisation efforts in the developing world. This should involve a discussion about how the money raised by a CBAM should be spent, and whether it could be allocated to specific development projects. Regardless, the potential impact of a CBAM on developing countries cannot be ignored. Solutions building on existing EU schemes are readily available and pose little risk to the EU’s wider carbon-reduction objectives.

2: ‘List of least developed countries (as of 11 February 2021)’, United Nations Committee for Development Policy, 2021.

3: ‘Carbon border adjustment mechanism as part of the European green deal’, European Parliament legislative train schedule, March 2021.

4: Sam Lowe, ‘EU border carbon adjustment: proposed models and the state of play’, in ‘Schwerpunkt Außenwirtschaft 2019/2020 Internationaler Handel und nachhaltige Entwicklung’, Oesterreichische Nationalbank, July 8th 2020.

5: Heli Simola, ‘CO2 emissions embodied in EU-China trade and carbon border tax’, Bank of Finland Institute for Economies in Transition policy brief, January 22nd 2020.

6: Kira Taylor, ‘Carbon border levy should be in place no later than 2023, EU lawmakers say’, Euractiv, February 8th 2021.

7: ‘Mid-term evaluation of the EU’s Generalised Scheme of Preferences (GSP) – final report’, Development Solutions Europe Ltd for DG Trade, July 2018.

8: ‘Non-preferential origin’, DG TAXUD, 2021.

9: ‘EU imposes safeguard measures on rice from Cambodia and Myanmar’, European Commission, January 16th 2019.

Sam Lowe is a senior research fellow at the Centre for European Reform.

This paper is published in partnership with the Open Society European Policy Institute.

View press release

Download full publication

Comments

Cheers