A hitchhiker's guide to Galileo and Brexit

The debate between the UK and the EU over British participation in the EU’s space programme ‘Galileo’ shows how difficult it will be to disentangle economic and security interests during Brexit negotiations.

The UK and EU will struggle to negotiate a security partnership, despite both sides wanting one. They have encountered their first real disagreement, Britain’s participation in the EU’s space programme Galileo. The EU does not want to rely on British industry for technology used in Galileo. The UK is threatening to retaliate by stopping tech transfers to the Union altogether, and building a competing satellite programme. The debate over Galileo demonstrates the problems that underlie defence negotiations: it is difficult to disentangle economic and security interests, and the EU is reluctant to grant concessions to a close strategic ally like Britain beyond those it offers other third countries outside the EU, even if it is in its own security interest to do so. The fight has already corroded goodwill on both sides – even though negotiations over security have not officially begun.

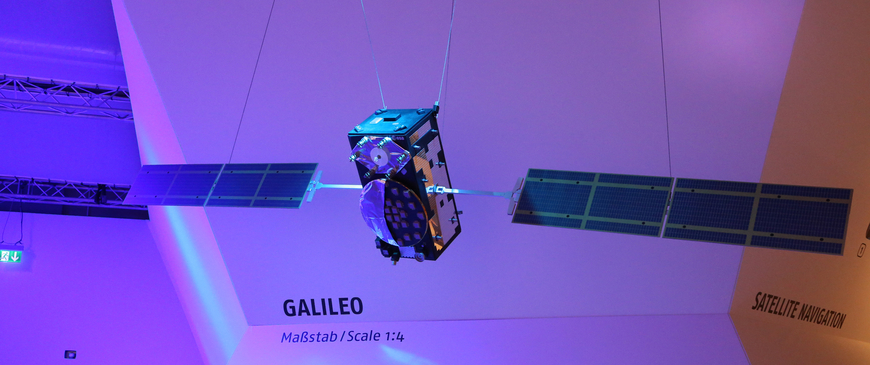

Galileo is Europe’s own global navigation satellite system, conceived as a competitor to the United States’ GPS, Russia’s GLONASS and China’s Beidou. The system is planned to be up and running by 2020. While Galileo’s basic positioning services will be open to all, the EU is also developing the ‘Public Regulated Service’ (PRS), an encrypted capability that is reserved for EU member states’ militaries and governments. PRS will use a range of different radio frequencies to broadcast encrypted signals, ensuring that the navigation service remains functional even if an adversary jams all other Galileo transmissions.

For the EU to interpret strategic autonomy as autonomy from the British defence industry is short-sighted.

Britain has been closely involved in the development of the Galileo programme. The British space industry has a turnover of around £14 billion per annum and employs close to 40,000 people. Currently, around 50 per cent of UK space industry exports go to Europe. The UK wants to increase its industry share up to 10 per cent of the global space market by 2030. In current projections, participation in Galileo (and other EU space programmes, like earth observation programme Copernicus) is essential to that goal. According to industry representatives, since the start of Galileo in 2003 the UK has funded about 12 per cent of its annual budget, and received contracts worth about 15 per cent. Surrey Satellite Technology, a British subsidiary of Airbus, makes Galileo’s navigation electronics. And a UK subsidiary of the Canadian firm CGI is developing the encryption technology for PRS.

Around three-quarters of UK space spending is funnelled through the European Space Agency (ESA). The ESA funds space R&D and scientific co-operation, and it also acts as the procurement agent for Galileo. Two non-EU countries, Norway and Switzerland, are full members of the ESA, and Canada is an associate member. But despite the fact that the ESA is not part of the EU, Brexit might affect how the UK can participate. Because the EU itself is the largest funder of the ESA, it is the EU that sets the rules for how Galileo should be procured, and which countries should have access to contracts.

After Brexit, the UK wants to maintain access to Galileo data, both its navigation data and behind the scenes insight into the technology. It wants its armed forces to be able to use Galileo’s PRS signal. And it wants UK-based companies to be able to continue to bid for Galileo contracts. For Britain, these demands are indivisible. Ahead of the next round of contracts for new Galileo satellites (needed to improve Galileo signal availability worldwide), however, the EU has introduced a break clause, which gives it the right to cancel existing Galileo deals without penalty once a supplier is no longer based in an EU member-state. In effect this prevents UK companies from winning contracts even while the UK is still an EU member, because once the UK leaves the break clause might be triggered.

PRS is a particularly sore point. The UK government argues that because it has played an important role in the delivery of the secure system, it should get guaranteed access to PRS. But the Commission has said that the UK, as a third country, cannot be granted access to sensitive EU-only information. The draft withdrawal agreement also prevents UK access to ‘security-related’ information during the transition. The Commission insists that for the UK to get access to PRS, it would have to give security guarantees to protect sensitive EU information after Brexit, and conclude an information-sharing agreement as well as a PRS agreement.

The UK is sceptical, though, that the EU would ever sign off on a PRS deal. This is understandable: after all, Norway is a member of the ESA and contributes to Galileo funding; it has signed a security agreement covering the exchange of classified information, as well as a co-operation agreement on satellite navigation in 2010. And yet it has not been able to conclude a PRS agreement. The United States Defence Department has similarly been put on hold by the EU. The Commission says that it plans to complete negotiations with Oslo and Washington by the end of 2018 (though it is more optimistic that it will be able to secure a deal with the former in that timeframe).

After March 2019, Britain, like Norway and the US, would have to apply for an agreement on access. But the Commission insists that it cannot let UK-based firms provide the most sensitive technology for Galileo’s PRS, because that would make the EU dependent on a third country for an essential part of the system. The EU’s rules for access to the public regulated service state that third states are not allowed to manufacture particularly security-sensitive parts of the system. The Commission argues that if the EU-27 rely on Britain that would endanger the integrity of Galileo’s PRS, and would be irreconcilable with the EU’s ambition to achieve ‘strategic autonomy’, the ability to pursue its defence interests independently.

For Britain, however, just being a user of PRS is not enough. Defence experts in the British government say that Galileo will not fulfil their security needs if the UK is shut out of the development of PRS technology and has no say over the future development of the service or its governance. Commercial interests are also playing a role in the row: the British suspect the EU’s tough stance is motivated by industrial interests, with the EU-27 keen to take business from UK firms. They point to the fact that France’s Thales is currently trying to buy CGI UK’s encryption expertise so that it can bid for PRS contracts once Britain is out. And they argue that if UK-based firms are shut out of PRS contracts, and the country sees industry fleeing to Europe, the UK would have to reassess the business case for participation in Galileo. The system might no longer provide enough value for money to justify the UK’s continued participation – and continued payments – after Brexit.

The UK’s threat to launch a competitor to #Galileo suggests to EU hardliners that the commitment to European security co-operation is thinner than Theresa May made it out to be.

Instead, the UK is threatening to opt out of Galileo altogether and build its own satellite network. That would cost money – Galileo will have cost €10 billion by the time it becomes operational in 2020 – though some in Whitehall estimate that because of UK-based expertise, developing a sovereign network would annually only cost the UK about as much as its current GNI contributions to Galileo. From a strategic defence perspective, the necessity of a British system is questionable. Britain’s closest defence allies are the Europeans and the Americans through the NATO alliance and the Five Eyes Agreement, an intelligence alliance between the United Kingdom and the United States, Australia, Canada and New Zealand. While some redundancies between the European and the American navigation systems are useful to provide resilience, it is unclear what a British system could add. An independent system would also make industrial co-operation with Britain’s European partners harder, because all technology relying on navigation satellite signals would have to be equipped with receivers compatible with Galileo, GPS and the UK system. This could cause trouble for projects like the Franco-British missile development programme.

The EU would lose out as well. With Britain ineligible to bid for contracts, EU firms like Thales could benefit in the short term. But the loss of British expertise on space would be a loss to the entire EU space project. Paul Verhoef, the ESA’s director of satellite navigation has cautioned that shutting the UK out could lead to delays in Galileo. Verhoef’s comment reveals the close relationship between the UK and the ESA – too close for comfort for some in the Commission – who worry that the UK might use its veto to slow down Galileo co-operation in the ESA. If the conflict between the Commission and the UK escalates further, the Commission may assert control by taking away the ESA’s procurement mandate for Galileo and incorporating it into EU structures.

The EU’s position on #Galileo implies that the Commission will be unwilling to adapt the approach it takes towards third countries, even if there are long-term benefits to co-operating closely with Britain.

For the EU to interpret strategic autonomy as autonomy from the British defence industry is short-sighted. Instead, strategic autonomy should be understood as the objective to enable Europeans to follow through on their own defence policy goals. That implies strengthening European militaries and defence industrial structures, to make the EU less dependent on the United States. Autonomy was part of the rationale for building Galileo: European armed forces, their armament systems, tanks and aircrafts today rely to a large extent on the US GPS signal, be it for precision strikes, surveillance, or secure communication and navigation. GPS is controlled by the US military. The US government initially reserved the right to restrict access to GPS signals at its discretion, but changed its policy in 2000. The US and the EU have since signed an agreement to combine data provided by Galileo and GPS, which increases the accuracy of both systems’ positioning data. But the EU also considers Galileo to be an insurance policy, to make its own defence infrastructure more resilient and reliable, in case the US system’s security, or the alliance with the US itself, ever becomes compromised.

Yet the EU is using strategic autonomy considerations as an argument against co-operating with Britain, which even after Brexit will remain a European liberal democracy, with almost identical security interests to the remaining EU member-states.

Some in the EU may truly believe that Brexit Britain can no longer be trusted as a strategic partner. They see Britain’s decision to leave as an attack on the fundamentals of European co-operation. But since the referendum, Britain has repeatedly pledged its commitment to European security. The EU should encourage this approach, and not allow the post-Brexit economic relationship to taint the future defence relationship.

Instead, the EU’s position on Galileo and its exclusion of Britain on security grounds implies that the Commission will be unwilling, in this case and in future defence negotiations, to adapt the approach it takes towards third countries, even if there are long-term benefits to co-operating closely with Britain. For its part, the UK’s threat to launch a competitor to Galileo suggests to EU hardliners that its commitment to European security co-operation is thinner than Theresa May promised in her Munich Security Conference speech in 2018.

The debate over Galileo has exposed a clash between bureaucrats and defence experts and between military and economic interests. If this conflict is not defused, it risks souring future security negotiations between the EU and the UK.

Sophia Besch is a research fellow at the Centre for European Reform.

Add new comment