Towards a decarbonised energy system in a larger EU

- To join the EU, candidate countries have to meet a range of regulatory requirements, including liberalising their energy markets and setting up the policy architecture to decarbonise the energy system. This is a challenge in countries that are still largely reliant on fossil fuels.

- The energy crisis following Russia’s full-scale aggression against Ukraine has hastened the partial integration of EU candidate countries into the EU energy market. But their alignment with EU energy policy is progressing slowly – though with some important differences.

- It is in the mutual interest of both current member-states and candidate countries to accelerate the latter’s integration into the energy union: a larger electricity market can draw upon more energy generators, lowering EU average prices, and enhance energy security.

- The EU has an interest in strengthening its support for energy policy progress in its neighbourhood. The Commission should help governments in candidate countries monitor and manage the price impact of a shift to liberalised energy markets, to avoid spikes in energy poverty.

The energy crisis that arose out of Russia’s war of aggression on Ukraine has highlighted the need for the EU to strengthen its energy security. This has increased awareness of the alignment between European efforts to decarbonise its energy mix and to enhance energy security: renewable energy simultaneously cuts emissions and reduces dependence on imported fossil fuels. As long as the EU energy system continues to rely on imported natural gas and oil, energy supply diversification will remain a priority, and a particularly urgent one among member-states that were still highly reliant on Russian gas and oil when the war broke out. Furthermore, the energy crunch has shown that the energy union is still fragmented: electricity interconnections between markets are limited and overloaded, which leads to diverging prices across Europe and can make some regions vulnerable to energy shocks.

The crisis has, to an extent, accelerated the integration of EU neighbours and prospective members into the EU energy market, for instance hastening the synchronisation of the Ukrainian and Moldovan electricity grids with the EU’s. But the alignment of EU candidate countries with EU energy policy is progressing slowly – though with some bright spots. If participation of these countries in the energy union is to become an early milestone en route to full EU membership, policy alignment should accelerate in a number of areas. Both EU member-states and candidate countries would benefit from their early integration into the EU energy market: a larger electricity market can draw upon more energy generation assets, delivering overall lower prices, and act as an insurance policy against localised disruptions. The EU has an interest in strengthening support to its neighbours to help them progress in implementing energy transition policy. Examples of this are the EU’s targeted support for the modernisation of the energy system in the Western Balkans, for energy security in Moldova and for the reconstruction of a more sustainable and secure energy system in Ukraine.

The EU has an interest in strengthening support to its neighbours to help them progress in implementing energy transition policy.

This article outlines the key elements of the energy mix in EU candidate countries, and where they stand in terms of aligning their energy policy with that of the EU. It concludes by identifying the key requirements for a truly interconnected and decarbonised energy union in an enlarged EU.

A snapshot of the energy mix in EU candidate countries

There are currently eight formal candidates for EU membership: Albania, Bosnia and Herzegovina, Moldova, Montenegro, North Macedonia, Serbia, Türkiye and Ukraine. Kosovo has also applied to become a candidate, while Georgia has paused its accession bid. Negotiations have already started with several countries. This analysis focuses on current candidate countries from the Western Balkans and Eastern Europe, excluding Türkiye whose accession negotiations have stalled.

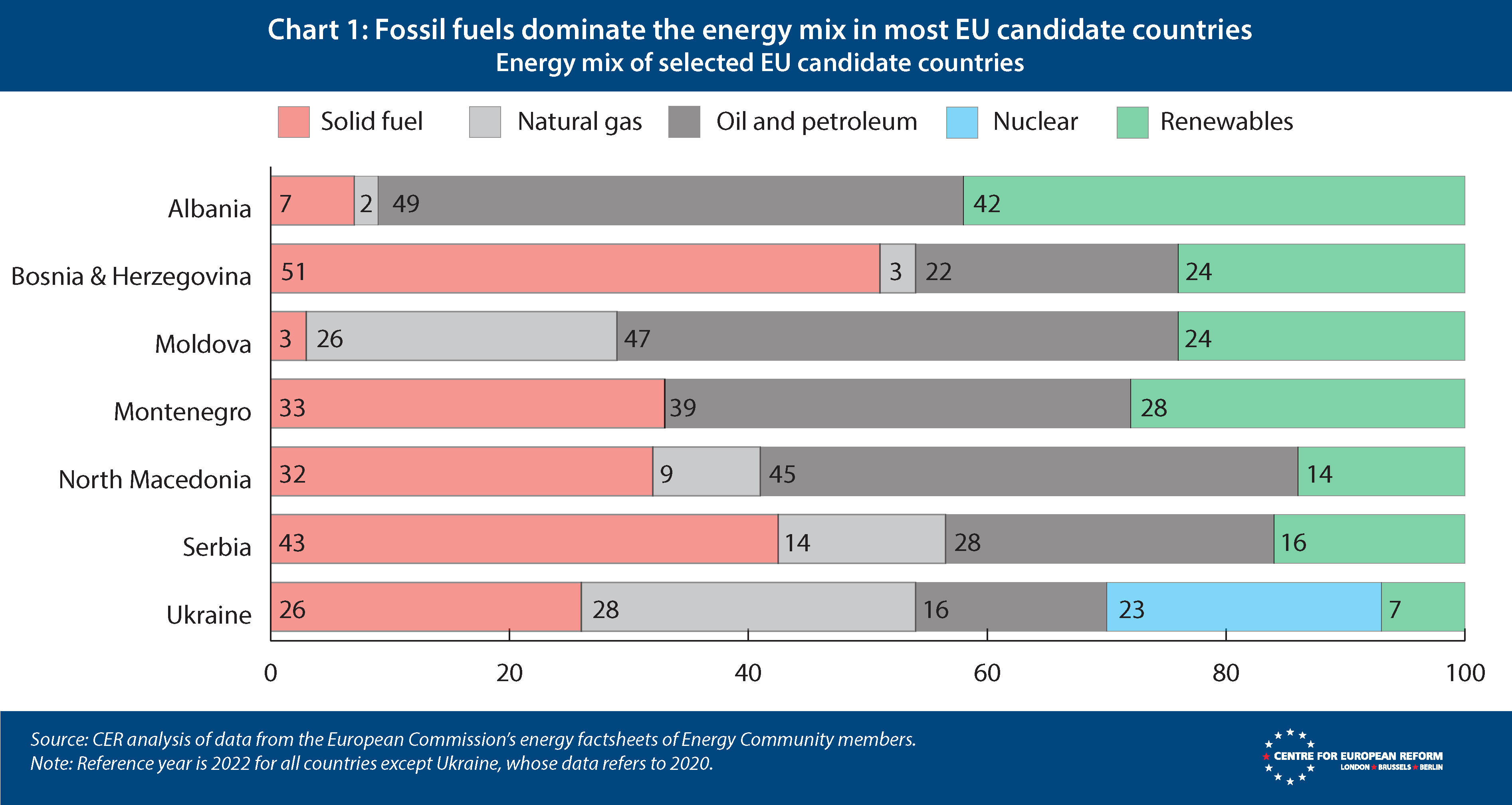

The energy mix of EU candidate countries is dominated by fossil fuels (including solid, oil and petroleum, and natural gas), which contribute about 70 to 90 per cent of the energy mix across all countries except for Albania (Chart 1). Oil and petroleum are the main energy source through other countries, with the exception of Bosnia and Herzegovina and Serbia, which each rely on solid fossil fuels for about half of their energy mix. Natural gas contributes about a quarter of the energy mix in Moldova and Ukraine.

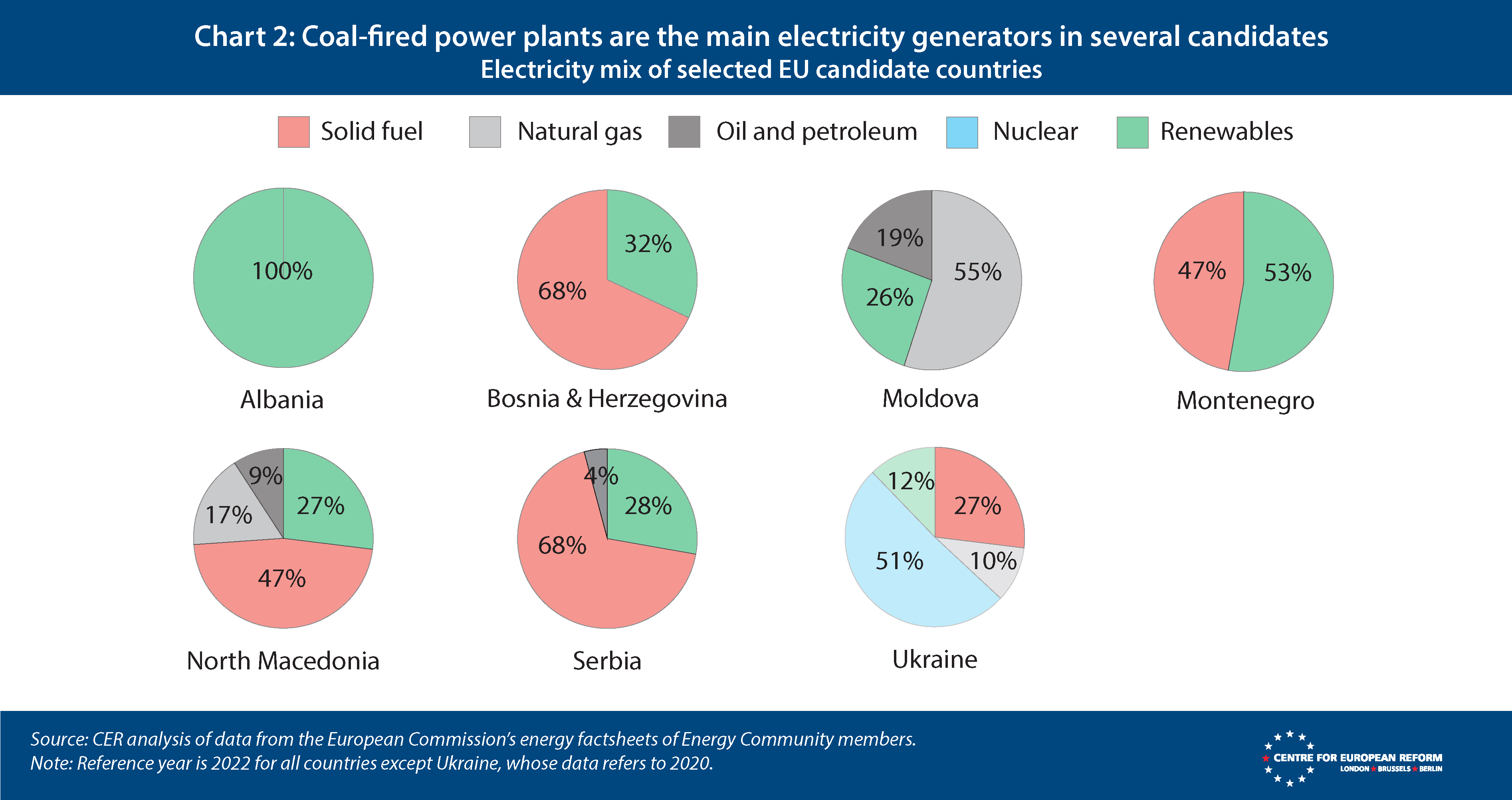

The mix of energy sources for electricity generation is even more diverse, as shown in Chart 2. Coal dominates the electricity mix in much of the Western Balkans. Coal-fired power plants remain the main generators of electricity in Bosnia and Herzegovina (largely with domestic lignite) and Serbia (where it is increasingly imported): these plants provide about 70 per cent of electricity and there is no legislated phase-out date for coal. In Montenegro and North Macedonia coal-fired generation provides just under half of the country’s electricity, mainly with domestic lignite, but with planned phase-out dates respectively by 2035 and 2030.

Albania entirely relies on renewable energy sources – primarily hydro – for power generation. Large hydro power plants also make up the bulk of renewable-based power generation in Bosnia and Herzegovina, Montenegro and Serbia.

Moldova is in a different position, as the sole candidate country relying on natural gas for over half of its power generation. However, this dependence has been declining: since Russia’s full-scale invasion of Ukraine, Moldova has shifted away from natural gas and partly replaced it with heavy fuel oil generation, which in 2022 contributed to 19 per cent of power generation, up from 3 per cent in 2020. Renewable-based generation has also increased, thanks to increasing deployment of both solar and wind.

Ukraine is unique among candidate countries in its reliance on nuclear power for over half of its electricity mix, followed by coal-fired power plants (though the phase-out of coal for power generation is planned for 2035). However, Ukraine’s situation is exceptional: much of its energy infrastructure has been destroyed since Russia's full-scale attack in 2022, leaving it in a constant battle to maintain an adequate supply.

Aligning candidate countries’ energy policies with the EU

Integrating candidate countries in the energy union ahead of their full entrance into the EU can deliver benefits both to current and prospective EU members. This is even more relevant in view of large-scale electrification, which requires an increase in European electricity supply to match demand with flexible and affordable energy.

In the electricity sector, pooling more national energy markets in the energy union ensures that the cheapest generation across the continent is put to good use. With the potential for renewable energy generation in candidate countries particularly high, it is fully in the EU’s interest to support speedy deployment of these resources, and their integration in the EU energy market.

A larger and better interconnected electricity market is also an asset for energy security: in case of localised disruptions, member-states can rely on imports from neighbours through interconnectors. This can contribute to avoiding shocks to the energy system in the event of temporary disruptions. For example, France temporarily shifted from being a net exporter of electricity to being a net importer while several of its nuclear power plants were undergoing unplanned maintenance in 2022: tapping into energy imports, it avoided disruptions to its energy supply. Conversely, the Iberian peninsula is rather isolated from the rest of the European power market due to its limited interconnections to France. Higher capacity interconnections offer a buffer power supply from neighbouring countries, which could have been helpful in the context of the major blackout that took place in Spain and Portugal in April 2025.

Countries’ readiness to join the EU energy market depends on their alignment with EU energy policy. Some of the EU’s neighbours and candidate countries have already started aligning their energy policies with the requirements of the EU internal energy market through their membership in the Energy Community – an international organisation funded in 2005 which now includes the EU, Albania, Bosnia and Herzegovina, Georgia, Kosovo, Moldova, Montenegro, North Macedonia, Ukraine and Serbia (while Armenia, Norway and Türkiye have observer status). Parties to the Energy Community commit to EU rules on energy, environment, competition and renewables.

Countries’ readiness to join the EU energy market depends on their alignment with EU energy policy.

The general principles for EU accession, embedded in the Copenhagen Criteria, involve having stable institutions, a functioning market economy, and the ability to assume obligations of EU membership. There are concrete preconditions for energy policy: regulation must be designed and implemented by stable and competent institutions and administrations. Candidate countries must align with the EU acquis in three main areas: liberalisation of the energy market; security of supply; and renewable energy and energy efficiency.

Aligning with EU energy regulation requires candidates to ‘unbundle’ the operation of energy generation, transmission, distribution and supply both for gas and electricity. Unbundling ensures that there is no monopoly controlling both energy supply and access to the grid: separating these tasks ensures new entrants can freely access the energy market, driving down consumer prices. This means candidate countries must shift away from legacy monopolies and towards a competitive market where different stakeholders have specific roles throughout the various stages of energy provision. On retail markets, consumers should have the possibility to pick their preferred energy provider. Independent regulators should be established to oversee the correct functioning of the market.

Concerning security of supply, candidate countries are required to implement emergency plans to respond to disruptions of gas and electricity supply, as well as to meet minimum oil stock requirements. They should have in place policies to diversify both energy sources and supply channels.

Finally, when it comes to renewables and energy efficiency, candidate countries should set national-level targets for both. National energy policy should include stable support schemes for renewables, and facilitate their integration into the grid. Similarly, energy efficiency improvements should be encouraged with sectoral measures.

How are candidate countries faring in these respects? As this analysis focuses on countries that are also members of the Energy Community, the 2024 report by the Energy Community Secretariat is a useful resource. It provides an assessment of their integration into the EU electricity market and of their advancement towards EU energy policy targets.

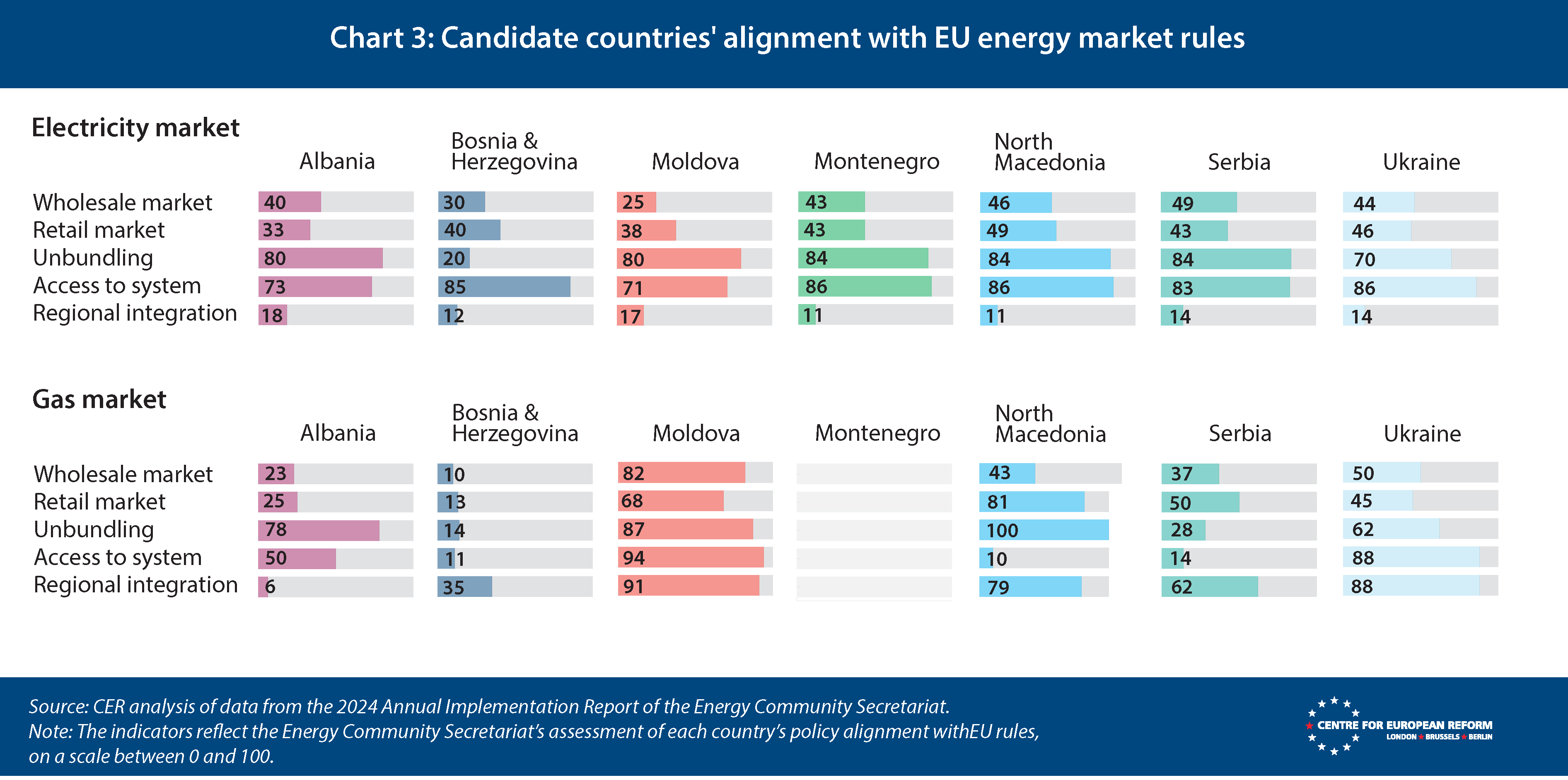

In the electricity market, aside from Bosnia and Herzegovina, all countries have made good progress on unbundling generation from transmission and distribution (Chart 3). Similarly, regulation governing connection to the grid is largely unproblematic. But candidate countries still have a way to go to guarantee fully functional and competitive power markets. Wholesale power exchanges are still developing: the objective is to create trading platforms where energy generators can sell their energy supply with different time horizons. On retail power markets, meeting EU requirements means ensuring consumer access to a variety of suppliers, which is not yet the case across all candidates.

Regional integration remains low, as differing national regulations cause legal barriers to energy trade, and limited transmission capacity is a physical barrier. Readying power systems for integration into the EU power market also means improving interconnections amongst candidate countries. Interconnections between the Western Balkan countries are particularly limited due to slow regulatory progress and to the fact that grid capacity made available for cross-country electricity trade remains low.

In the gas market, progress is more mixed. Unbundling in the gas sector translates into separating gas supply (sales) from the operation of the transmission grid, which allows suppliers to deliver gas to consumers. This ensures that there is no monopoly handling both supply and access to the grid, allowing new entrants to access the gas market, which in turn can drive down consumer prices. Full unbundling is yet to be achieved in all candidate countries. Furthermore, because long-term contracts still prevail for gas supply, the size and liquidity of the wholesale gas market is still somewhat limited.

Breaking down monopolies in a strategic sector like energy comes with political economy challenges. Energy monopolies have historically been in the hands of state companies, which are generally among the largest corporations in each country: reforming the role of these companies in the energy supply chain and the governance of their operations translates into curbing their power and downsizing their role in the national economy. This would suffice to cause resistance – but on top of this, incumbent energy generators in coal-reliant candidate countries also face the threat of climate targets, which directly pressure them to decarbonise their supply and phase out coal. The adoption of coal phase-out targets can lead to clashes between governments of candidate countries and incumbents, potentially translating into vote losses in areas where coal mining and coal power plants are important employers.

Breaking down monopolies in a strategic sector like energy comes with political economy challenges.

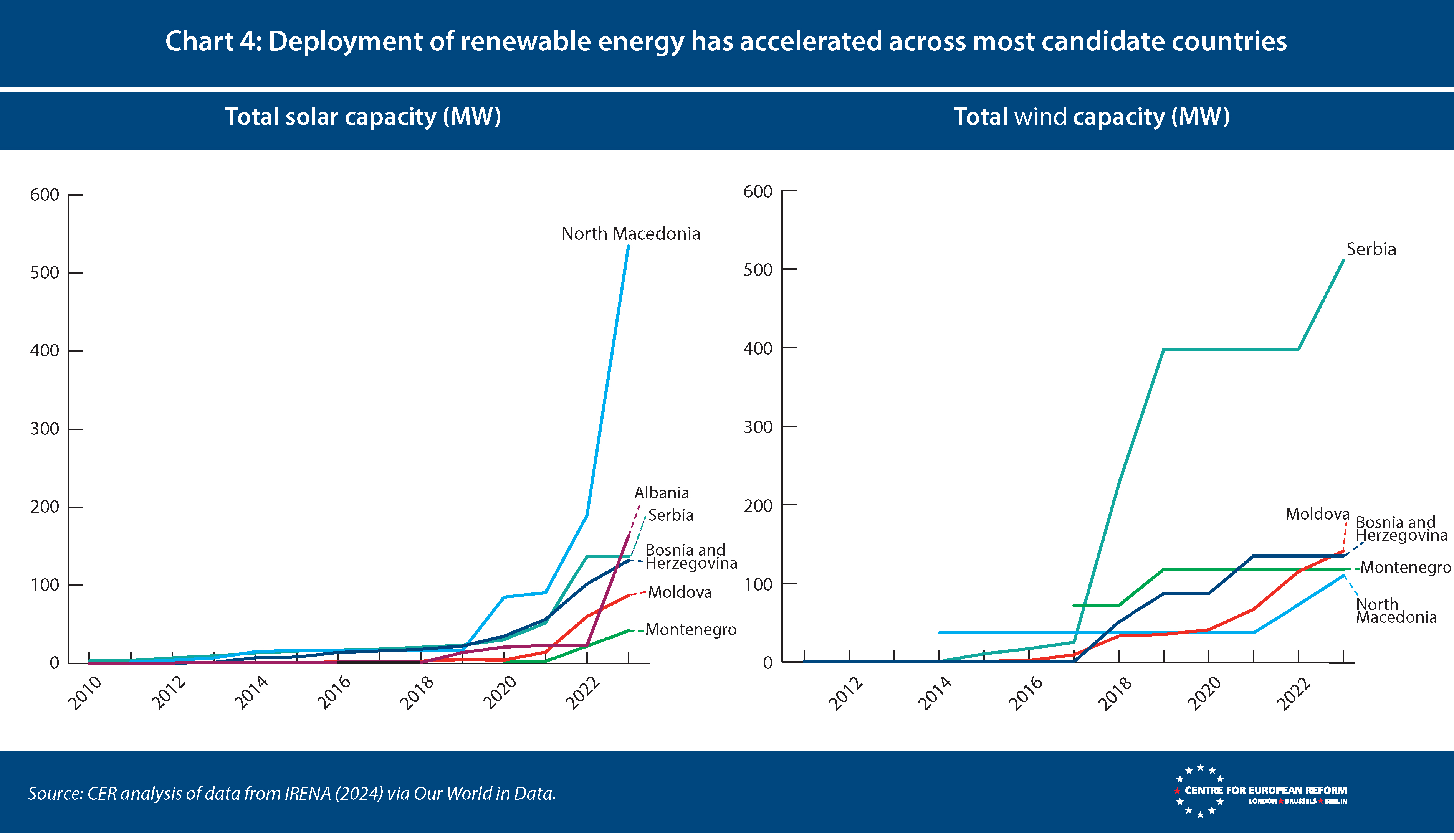

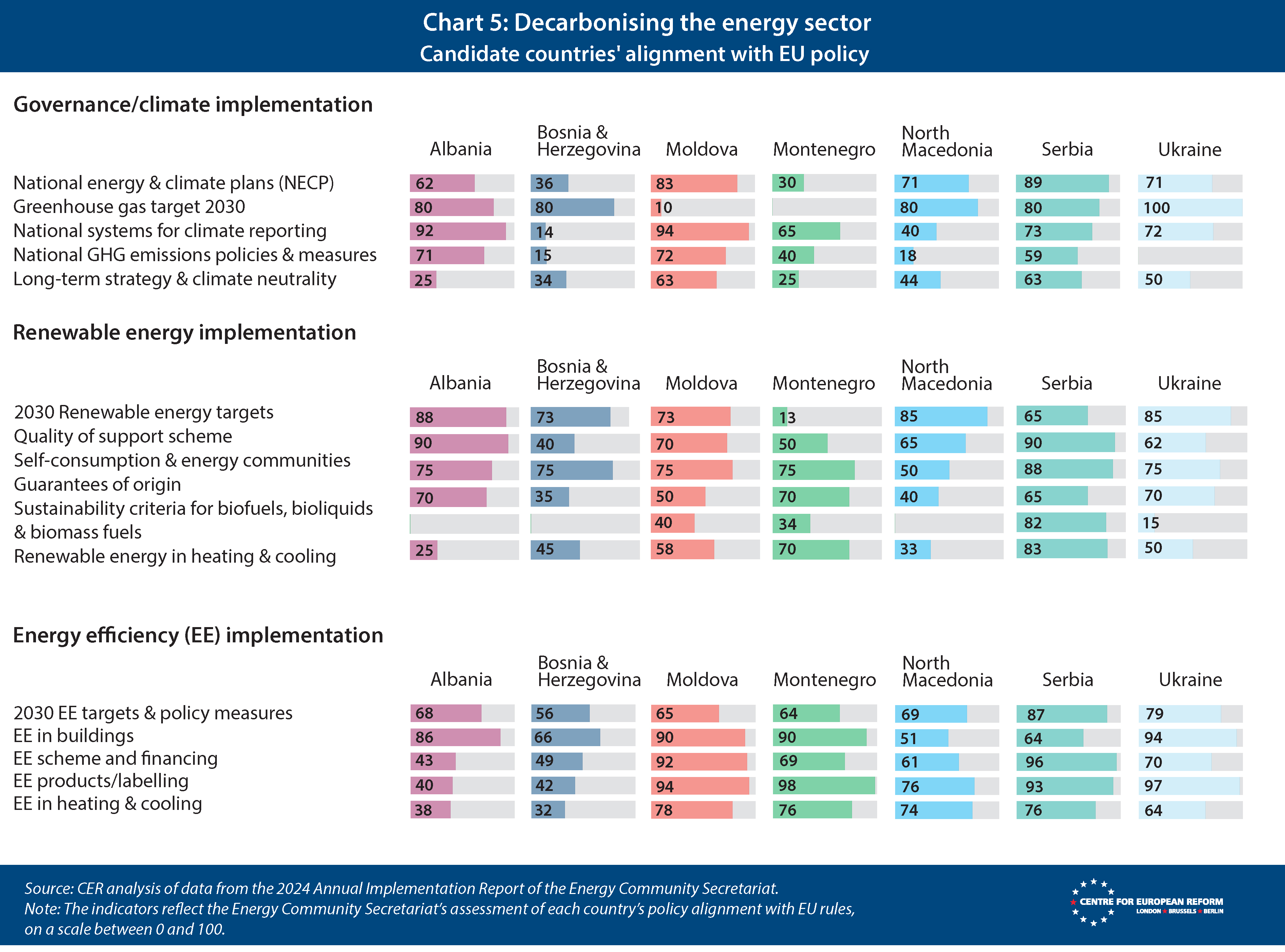

Though the energy mix of candidate countries is on average still more carbon intensive than in the EU-27, Chart 4 shows that the deployment of both solar and wind energy has substantially accelerated across EU candidate countries in the past ten years, albeit at slightly different speeds. Ukraine’s deployment is not reported in the chart as the scale of its renewable energy capacity is vastly higher, having reached 14,921 MW in 2021, including all solar and wind installations. These developments underscore the importance of implementing policies that set credible but ambitious emissions reductions goals, and tie them to investment targets in green energy. These goals need to be backed with clear regulatory frameworks and support schemes to attract such investments. As Chart 5 illustrates, several candidate countries have been making good progress in this direction, but more needs to be done to align their policies fully with those of the EU.

In fact, several weaknesses of the electricity system can act as barriers to the deployment of renewables: limited available transmission capacity, which prevents delivery of renewables to consumers; immature electricity markets, which can hinder financing; and weak regional co-ordination and grid interconnections among neighbours, notably in the Western Balkans. Political economy aspects, such as the risk of losing the many jobs attached to the coal industry, further complicate the decarbonisation of the energy sector.

When it comes to decarbonisation, EU candidates have to adopt emissions targets in line with EU 2030 climate goals, which aim to cut net greenhouse gas emissions by at least 55 per cent by 2030, compared to 1990 levels. Some countries still need to adopt 2030 and 2050 climate targets formally as part of their national legislation. Like EU member-states, they also need to approve a National Energy and Climate Plan (NECP) in line with these targets, setting out the path to curbing emissions in the energy sector and in the rest of the economy.

Alignment with the EU acquis also means adopting sectoral targets, such as for the deployment of renewables and energy efficiency, and implementing EU policies in these areas: Chart 5 shows progress in this sphere. The implementation of carbon pricing, and eventually integration into the EU Emissions Trading System, is also fundamental in driving the decarbonisation of the energy sector: this will be the subject of a subsequent CER insight in this series.

How to build a larger and cleaner energy union

Through the energy union, the EU aims to ensure “secure, sustainable, competitive, and affordable energy for all EU citizens and businesses”. Integrating the energy markets of all EU member-states and, increasingly, of EU neighbours ahead of their full accession helps strengthen energy security, reduce carbon emissions and ultimately drive down energy prices. For these reasons, expanding the energy union to include candidate countries as soon as their energy policy architecture is ready to sustain the obligations of membership, without necessarily waiting for full accession, would be mutually beneficial both for EU countries and for candidates.

In the era of electrification, integrating candidate countries in the energy union means bringing into the EU electricity market a region with great potential for renewable energy: for example, Global Solar Atlas data indicate that the average potential for solar generation in candidate countries is higher than in the EU. Because a higher share of renewables in the electricity mix drives down the wholesale electricity price, investing in renewables in these neighbouring countries and increasing interconnections between them and the EU would expand the pool of cheap energy available on the EU market.

Speedy integration of EU candidates into the internal energy market would enable them to signal the maturity of their regulatory frameworks, and thereby to attract further investment in renewable energy and the modernisation of their energy grids. Ultimately, a larger energy union is a better energy union, as expanding the EU energy market would support energy decarbonisation, energy security and energy affordability.

The prospect of EU enlargement provides an additional reason to further integrate EU energy markets, removing existing barriers that prevent them from delivering energy more efficiently across the EU, at more affordable prices.

Decisions on the energy mix of individual EU member-states remain a national competence. As a result, EU member-states take energy investment decisions, both on supply and infrastructure, largely based on national rather than EU-wide considerations. Planning for energy system developments at regional or EU level would be more efficient, allowing member-states to optimise investment and operational costs. This could also ease the administrative burden for smaller EU member-states, who could pool expertise with their neighbours: a particularly useful prospect for EU candidates, as most are small countries.

Planning for energy system developments at regional or EU level would be more efficient, allowing member-states to optimise investment and operational costs.

Existing assets could be used more efficiently too: the capacity of electricity interconnectors among EU countries and among candidate countries is not always fully exploited. For example, governments may fear that higher electricity exports to their neighbours could increase domestic prices – Norway has considered limiting exports to Germany for this reason. Such resistance to greater cross-country integration threatens the solidity of energy systems. In these situations, consumers in the exporting country could be compensated in the event of price increases, unlocking higher electricity trade across countries by addressing the political economy of winners and losers. It is in the interest of European electricity consumers to push for this, in order to bring down average prices.

It is in the context of these broader discussions on how to create a ‘genuine energy union’ that another big wave of enlargement may take place. In recent years, retail electricity prices across EU member-states have partially converged. This means that price differences across countries have decreased, though this is happening more slowly for households than industrial consumers.

After the 2004 enlargement, new EU members faced increases in energy prices. To pursue market liberalisation, new members shifted away from fully regulated prices, dropping cross-subsidies from industrial consumers to households, particularly present in the gas sector. Some of the 2004 entrants managed to smooth this price increase successfully over a decade, starting to reduce subsidies ahead of their EU accession; others postponed reforms, only to hit consumers with massive price increases down the line. These initial energy price increases have been partly ‘absorbed’ in the context of broader economic convergence and catch-up with Western Europe. Nonetheless, the price impact of a shift to liberalised energy markets should be monitored and carefully managed in accession countries, with vulnerable consumers supported to avoid spikes in energy poverty.

Investing in renewables would help bring down energy costs in the medium term, and adopting energy efficiency measures and improvements would similarly curb energy bills. Ideally, energy prices should reflect costs as opposed to hiding them through subsidies. Governments should counter energy poverty with financial transfers to vulnerable consumers, and investment support to help them reduce energy demand structurally and improve efficiency and comfort. Countries that join the energy union will need to adopt such policies as they move away from controlled energy prices.

Investing in renewables would help bring down energy costs in the medium term, and adopting energy efficiency measures and improvements would similarly curb energy bills.

The EU is moving towards an electrified economy based on largely renewable-based electricity and on a wisely interconnected grid. A more integrated EU energy market is necessary to lower and harmonise energy prices. Enlarging the energy union as soon as possible would contribute to accelerating the green transition both in current and future EU member-states.

Elisabetta Cornago is a senior research fellow at the Centre for European Reform.

This article has been supported by the European Climate Foundation. Responsibility for the information and views set out in this article lies with the author. The European Climate Foundation cannot be held responsible for any use which may be made of the information contained or expressed therein.

Add new comment