Why would anyone use a central bank digital currency?

Central banks are rushing to pilot their own digital currencies. These may sound exciting. But they may offer users few compelling benefits they do not already enjoy.

Consumers are abandoning cash in favour of digital payments – a long-term trend that rapidly accelerated during the pandemic. Central banks are fretting about the consequences. Are consumers too reliant on US card networks, which recently withdrew their services from Russia, demonstrating that even private payment systems can become drawn into international conflicts? Are alternative systems needed to improve the economy’s resilience to system outages, natural disasters or cyberattacks? Does it matter if there is no longer a public alternative to private payment services like card payments? And will consumers who value the privacy of cash adopt riskier alternatives like Bitcoin or stablecoins, some of which have been recently proven to be unsafe stores of value?

Nearly all central banks globally – including those in the EU, UK and US – are examining retail central bank digital currencies (CBDCs) such as the ‘digital euro’ as a potential answer to these concerns. Many are ploughing ahead with pilots already.

A retail CBDC would allow consumers access to electronic money backed by the central bank. Today, only commercial banks generally have this privilege, in the form of central bank reserves. Individuals can hold central bank money, but only in physical form – as banknotes and coins. When individuals hold funds electronically, those funds only represent a claim on the private bank that manages the account, not the central bank.

However, everyday consumers in Europe may find this revolution to be an academic one. Europe’s banking sector is robust and deposits are guaranteed up to a generous limit. Consumers, quite reasonably, consider bank savings to be about as safe as cash. And CBDCs would probably be provided via commercial banks, and could allow payments through a mobile app, a card, or a similar device. So a CBDC could look similar to any bank account today. State-backed savings options are already available for those who want them.

Whether consumers and retailers would actually prefer to use a CBDC for payments – rather than private payment services like today’s cards – is therefore not obvious. Some central bankers imply usage is unimportant, arguing that a CBDC merely needs to exist as an ‘anchor’, giving consumers certainty that money can be withdrawn from the private banking system. But cash still serves that purpose – and if the problem is that fewer consumers and retailers use cash, then a CBDC would only be a solution if it was more widely used instead. Other commentators assume the bigger risk is overenthusiastic adoption, in particular that CBDCs will be used for investment purposes and not just to make payments. They worry that if consumers can quickly shift their bank deposits into CBDCs, rather than needing to withdraw cash, banks would become more vulnerable to runs. And if consumers have more of their savings in CBDCs and less in bank deposits, then banks will need more expensive wholesale funding to provide loans to customers. That would drive up the cost of finance for households and businesses. To deal with this problem, CBDCs would need limitations – such as caps on individual holdings or unattractive interest rates – to limit the risks to private banks. But that will reduce its attractiveness to users: existing payment services do not generally have these limitations.

The primary objectives of a CBDC therefore cannot be achieved unless it is “available everywhere” and can win market share from today’s card payments. Yet CBDCs will struggle to compete.

The objectives of a CBDC cannot be achieved unless it wins market share from today’s card payments. Yet CBDCs will struggle to compete.

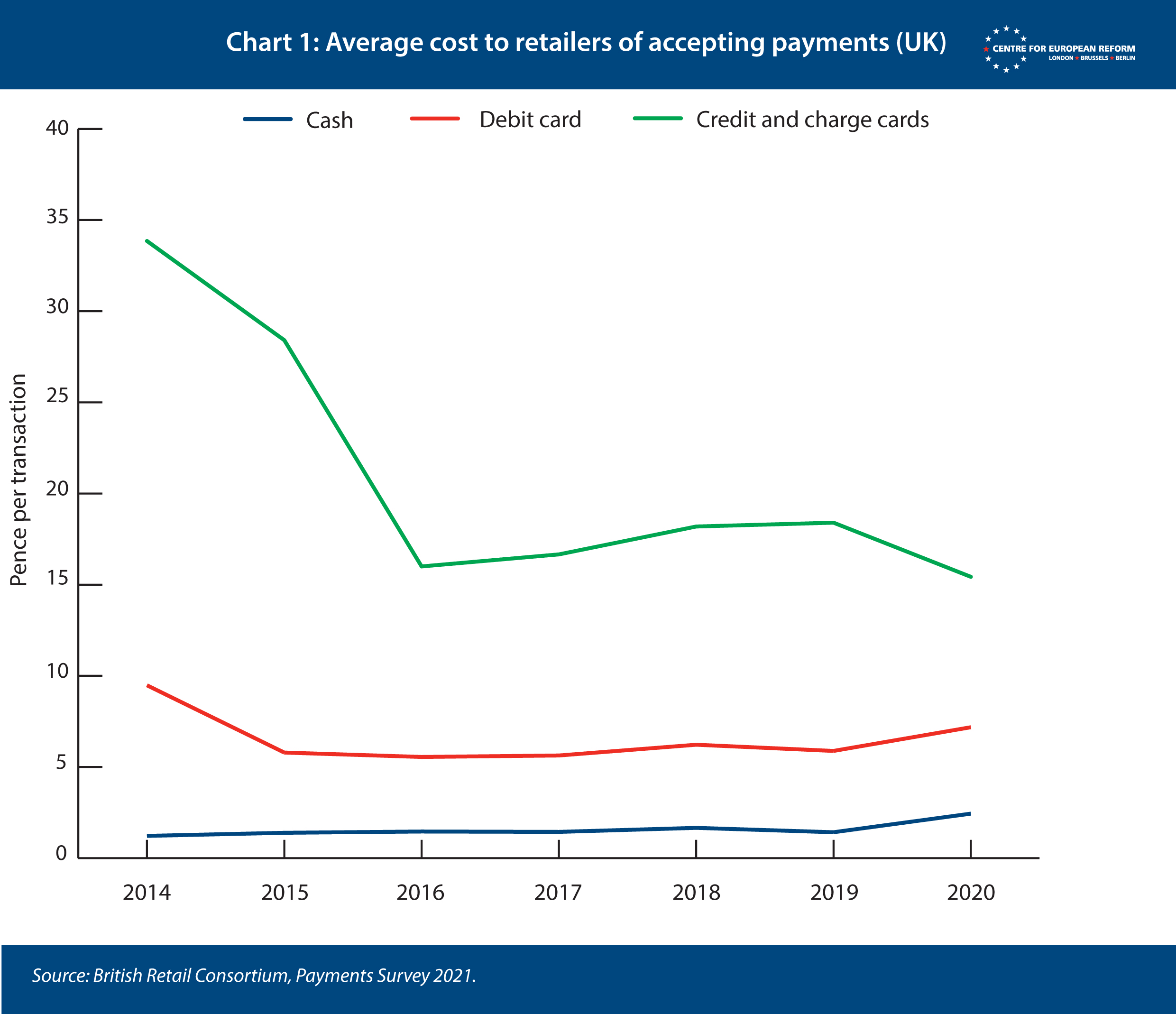

First, consider price: a CBDC should be financially attractive to both consumers and retailers. Some retailers could be enticed to accept it: many are concerned about the fees associated with accepting payment cards like Visa, Mastercard and American Express, despite regulatory reforms in 2015 which reduced these fees. A recent UK study showed that smaller retailers pay, on average, nearly 2 per cent of a total transaction’s value to accept cards. Cash is not getting more attractive either: it slows down the speed of transactions; carries risks of theft and loss; and as Chart 1 shows, retailers must pay more to deposit and handle cash as its usage declines. A CBDC could do better: it could be cheap like cash; and like electronic payments, it would be quick and safe to use.

But attempts to create cheaper alternatives struggle. Europe’s latest attempt to create a low-fee pan-European card network, the so-called European Payments Initiative, failed to create a viable business model for predictable reasons. The problem is that being cheap for retailers does not guarantee success. Consider the number of retailers becoming cash-free and only taking card payments – even though, as Chart 1 shows, cards can still be more expensive than cash for retailers to accept. Accepting multiple different types of payment methods gets expensive and complex. They prefer accepting one near-universal means of payment, such as Visa or Mastercard, that nearly all consumers also use. Introducing a CBDC would battle against this trend. Most CBDCs will not use existing card infrastructure, as doing so would contribute little to resilience and give CBDCs less competitive differentiation. So they would require retailers to invest in accepting a new form of payment, with uncertain demand, at a time when many retailers would prefer to simplify their options.

Being cheap for retailers does not guarantee success for a CBDC. Retailers are becoming cash-free – even though cards can still be more expensive than cash.

Law-makers may try to solve this conundrum by changing the law, so that a CBDC has the status of legal tender. That would improve a CBDC’s legitimacy: today, only banknotes and coins are legal tender. However, the legal ramifications of being legal tender are ambiguous. Only a few EU member-states force retailers to accept legal tender. In most of Europe, retailers are free to refuse banknotes and coins today, and could do the same with a CBDC. The European Court of Justice accepts that even government agencies can refuse cash if there are good reasons, such as electronic payments being more efficient.

Even if retailers accepted CBDC payments, that would only solve half the price challenge. Attracting consumers is more difficult. As I have explained, when consumers pay by card, they not only get a payment service at no cost, but receive benefits for using their card – such as liability protection for fraud, and potential cashback offers and reward points. These benefits are indirectly funded by the charges retailers pay when they accept a card payment. In most cases, EU law prohibits retailers from imposing a surcharge for consumers who pay by card. Even where surcharging is allowed, many retailers do not want to do so and risk annoying consumers. Consequently, consumers have strong incentives to pay by card, even though this imposes higher costs on the retailer.

Central banks are therefore mistaken to think a CBDC could succeed simply by being low cost or legal tender. CBDCs would also need to give consumers more benefits than established payment options do, such as by enticing users with cashback rewards. But that implies either subsidising the system using public funds – which would breach the ECB’s duty to respect an “open market economy with free competition” – or imposing higher fees on retailers than they pay today.

Other possible financial benefits for consumers will also fail to have the desired effect. Providing a favourable interest rate on holdings is one option. However, CBDC accounts might be legally unable to accrue interest in the EU. Even if they could, keeping the interest rate high enough to maintain the CBDC’s use could easily conflict with a central bank’s monetary policy objectives, and with the need to ensure consumers still had incentives to use private bank deposits. In any event, attractive interest rates would primarily influence consumers to use the CBDC as an investment vehicle – rather than as a payment option, as central banks intend.

If a central bank cannot shower consumers with monetary rewards for using a CBDC, perhaps consumers would be attracted to a retail CBDC for privacy reasons. Central banks have no incentives to exploit personal transaction data. And a CBDC could be designed so that small, in-person transactions could be made offline and without reporting the transaction back to a centralised ledger – making them more private than electronic transactions today.

But privacy is unlikely to be a compelling feature. The ECB has ruled out anonymity. This seems inevitable: central banks must stop their CBDCs being used for money laundering or terrorist financing. Caps on the amount users can hold in CBDCs will also be essential to protect banking stability, but multiple accounts would allow people to circumvent the account caps. So users will need to provide identification to the private banks which distribute the CBDC. But this means that consumers would simply have to trust that transactions are as private as banks say they are. That is unlikely to convert consumers who happily use cards today; nor will it likely satisfy privacy-conscious users who still use cash for its guaranteed anonymity.

Finally, one promise of CBDCs is to unleash more competition and innovation. The ECB, for example, is concerned that “just a few global players have come to dominate certain segments of the payments market”. It wants to design its CBDC in an open way, which allows developers to freely build features on top of the basic system. That would differ from private payment systems today, whose stakeholders benefit from the status quo and may not welcome disruptive innovation.

This argument has some merit – but caution is needed. The operators of today’s centralised payment networks are gatekeepers: they decide which innovation is allowed. CBDCs could unleash the most innovation if they do not rely solely on similarly centralised business models. For example, a CBDC which incorporated decentralised technology like blockchain could deliver some benefits that today’s services cannot, such as more privacy protections and pre-programmed payments, and could be better able to disrupt the payments market. But is unclear whether central banks will be prepared to adopt such relatively novel technology, or whether they should: the private sector, with proper regulatory oversight, may be better placed to experiment with how such technologies can best serve consumers. And the centralised structure of today’s card networks also provides innovation benefits, because the system operators can ‘pick winners’, and orchestrate the coordinated adoption of new innovations across the payment system, in ways which decentralised systems can find more difficult. If an open CBDC platform allowed any developer to add its own features, then there would be a ‘basic’ system – which would lack many benefits of card payments today – and then a bewildering number of add-ons from different developers. It is unclear whether consumers or retailers will be prepared to deal with this complexity. Compare this to centralised card networks, which allow limited differentiation – for example, banks offer their own rewards programs – but also require all participating banks to adopt some innovations, so that consumers and retailers can trust the security and features of a card payment.

CBDCs could unleash the most innovation if they do not rely solely on similarly centralised business models.

Funding a new public option is hard to reconcile with Europe’s retail payments reforms – which take a different, and more sensible, approach to encouraging competition and innovation. These reforms aim to open up the payments market to new competition in the private sector, including by supervising private sector digital currencies, while regulating card fees to keep retailers’ costs manageable in the meantime. But several policy problems still need to be resolved. First, the EU must decide how to balance price and competition. Retailers want lower charges, but doing so may limit innovation and provides less room for cheaper competitors to enter and disrupt the market. For example, higher card fees in the US have helped fund the growth of fintechs. Many of these fintechs are now developing new services that might eventually challenge card payments. Second, Europe needs to ensure consumers have incentives to choose cheaper payment methods, to help drive the price down. For example, if retailers had more power to influence how consumers choose to pay, Europeans might start using more diverse payment methods: cards when they needed cards’ unique benefits, and cheaper alternatives in other cases. Third, regulation should ensure the private sector reflects Europe’s needs. For example, regulation can supervise payment systems to ensure they are safe and resilient to cyberattacks and financial shocks; and regulators can ensure that when global payment systems operate in Europe, they reflect European values, such as protecting users’ privacy.

Central banks will struggle to rollout CBDCs that will be widely adopted. They may not provide consumers the same benefits as today’s services; privacy is unlikely to be a game-changer; and the private sector still offers scope for innovation. Without widespread adoption, a CBDC will be an expensive failure, and will do little to advance central banks’ goals. For the EU, regulation is a more sensible way to make European payments cheaper, and more diverse, competitive and innovative. The EU should not be distracted by the prospect of a digital euro – which may sound impressive and exciting, but may give Europeans few benefits they cannot enjoy already.

Zach Meyers is a senior research fellow at the Centre for European Reform.

Add new comment