Can the euro rival the dollar?

The international role of the US dollar is deeply entrenched. To change that, Europe – and Germany in particular – would need to rethink some core economic policies.

The dominance of the US dollar is a standing provocation to those who envision a more significant role for the EU in world affairs. The European economy is comparable in size and sophistication to the US economy, but its currency, the euro, plays second fiddle. For a long time, the dollar’s dominance did not seem to matter much. It did bring the US major benefits: cheap and almost limitless funding for its government, firms and consumers; and the ability to impose effective international sanctions, as the dollar’s dominance meant that no firm could violate them without risking major fines. But the US was not exploiting those advantages at the expense of Europe.

Now the Trump administration is weaponising economic policy, making the euro’s standing in global markets a question of foreign policy, rather than simply of economics. But the ambition to give the euro a greater role in global markets faces huge economic and political obstacles. Not only is the dollar’s role in the world economy deeply entrenched. The policy changes that would bring about the conditions necessary for growing the euro’s role – an ample supply of European safe assets and a European Central Bank (ECB) that recognises its worldwide responsibilities – would meet fierce resistance, especially in Berlin. Likewise, the consequences of increased global demand for the euro would challenge some of the eurozone’s core policies.

The consequences of increased global demand for euros and euro assets – lower interest rates and a stronger euro – would challenge some of the eurozone’s core economic policies.

Three things determine whether a currency is a reserve currency. The first is a currency’s role in worldwide transactions, such as trade invoicing and the financial transactions that facilitate trade. When two firms from countries with different currencies engage in a transaction, the most efficient currency to use is one that both can easily reuse for further transactions or exchange into their local currency with minimal risk of losses. As a result, most world trade is invoiced in a few dominant currencies.

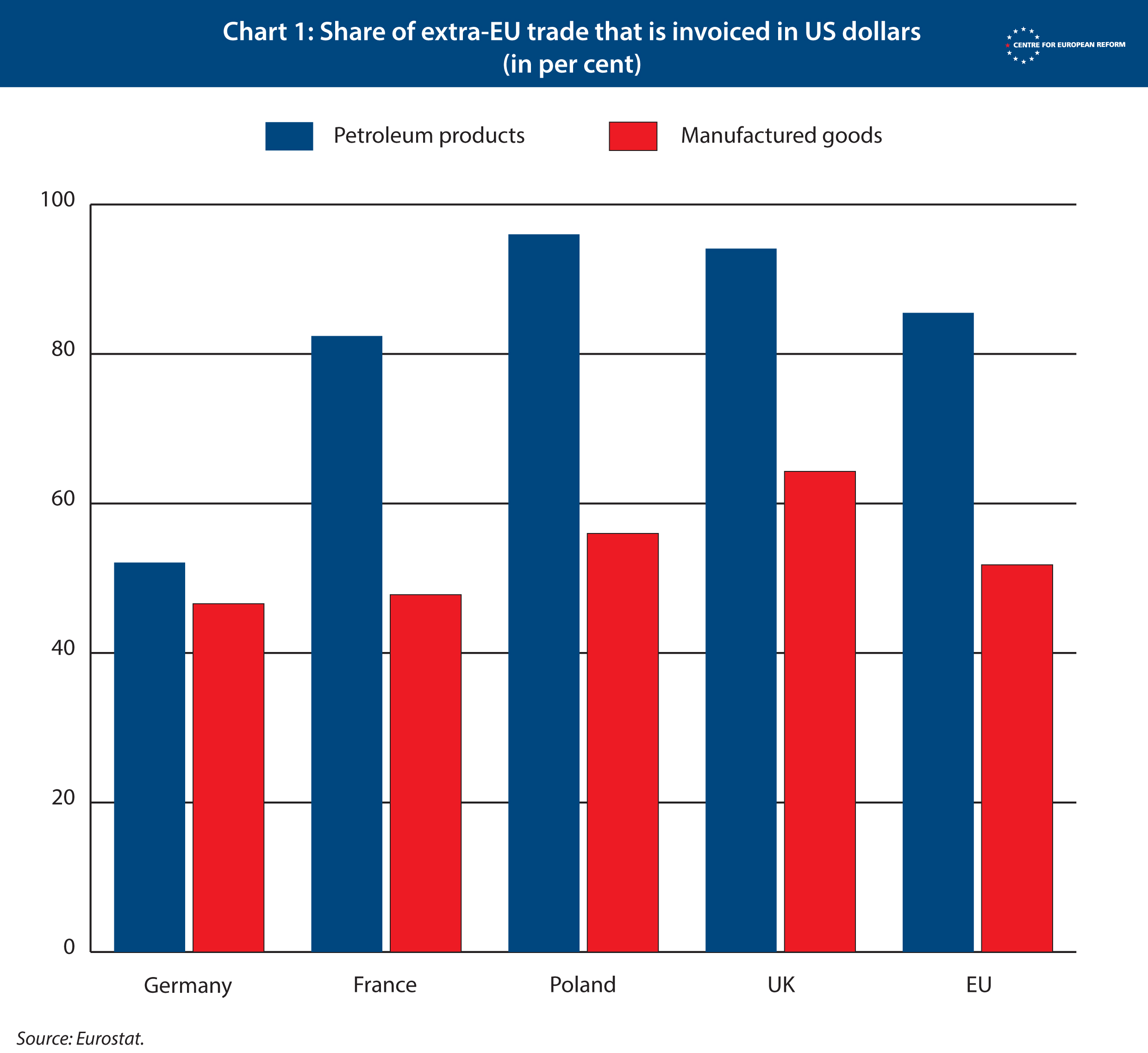

The US dollar is the most used trade currency, even when US companies are not involved. According to calculations by the International Monetary Fund’s (IMF) new chief economist, Gita Gopinath, 80 per cent of dollar denominated imports never touch the United States itself. By contrast, almost all trade using euros involves at least one eurozone country. Countries such as Brazil, India or Thailand invoice roughly 80 per cent of their imports in US dollars, even though imports coming from the US are just a small fraction of their total imports. British and Turkish firms invoice more than half of their imports in US dollars. Only eurozone firms, trading mostly within the eurozone, invoice chiefly in their own currency.

Notes: Data for Germany and Poland is from 2017, the rest from 2016.

Trade must be financed: exporters want to receive payment at the point of shipment, whereas importers prefer to pay only once they receive the product. The time lag is usually covered by company-to-company trade credit, or by a bank. Such credit is usually insured, often at government-subsidised rates to promote exports. In 2017 over $2 trillion worth of goods, or 14 per cent of total world trade, were insured by the Berne Union, the largest grouping of trade insurers. And if the US dollar is not the local currency, firms committing to buying goods in US dollars will want to hedge their currency risk, by buying financial derivatives that protect them from currency fluctuations. Of the $96 trillion of outstanding over-the-counter currency derivatives, $85 trillion involve the US dollar and only $31 trillion involve the euro. Trade invoiced in US dollars thus leads to trade credit, trade insurance and financial derivatives in dollars.

Of the $96 trillion of outstanding over-the-counter currency derivatives, $85 trillion involve the US dollar and only $31 trillion involve the euro.

The invoicing of global trade in US dollars also reinforces the tendency of international investors to prefer safe dollar assets – which is the second thing that makes a reserve currency. The ultimate goal of owning a safe asset is to be able to buy goods and services in the future. If trade in those products is invoiced in dollars, then it makes sense to hold safe dollar assets instead of, say, safe euro assets, let alone local currency assets. This creates high worldwide demand for safe dollar assets such as US Treasury bonds, senior corporate bonds and US mortgage-backed securities, driving up their price and depressing their yield. It also creates a ‘deep’ market: there are plenty of buyers and sellers willing to trade at any moment, enabling a quick exit if needs be. This is the “exorbitant privilege” that then French finance minister Valéry Giscard d'Estaing complained about in the 1960s: cheap and almost limitless funding for the US government, its firms and consumers, which they use on a huge scale. In doing so, they provide global investors with ample assets in which to invest.

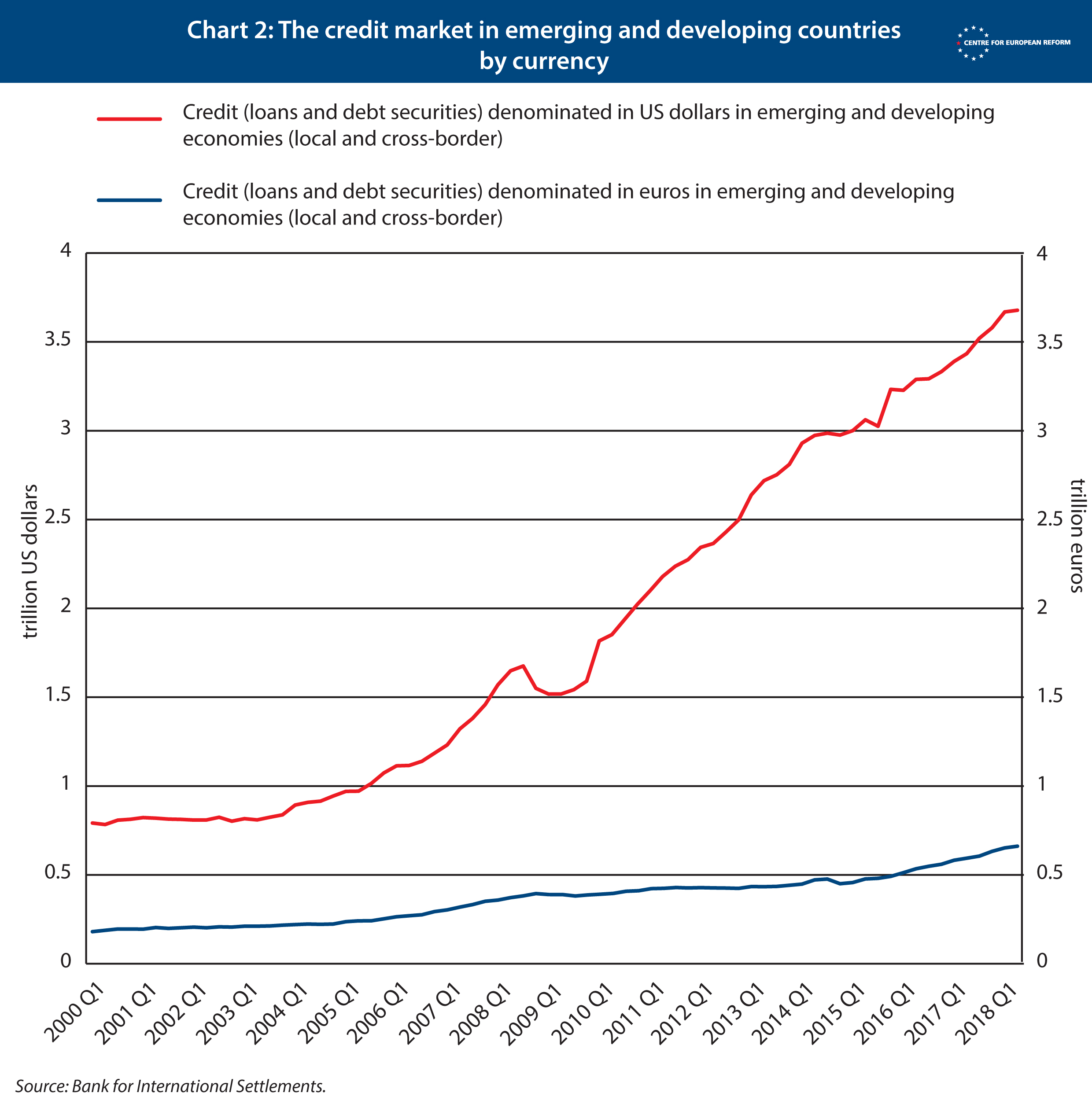

But it is not only US entities that benefit. The ‘hunt for yield’, where investors seek higher returns than those available in the US market, drives down borrowing costs for those who borrow in dollars outside the US. Non-US borrowing in dollars amounts to $11.5 trillion, of which emerging and developing economies account for $3.5 trillion. The corresponding figures for the euro are €3.2 trillion and €660 billion (Chart 2).

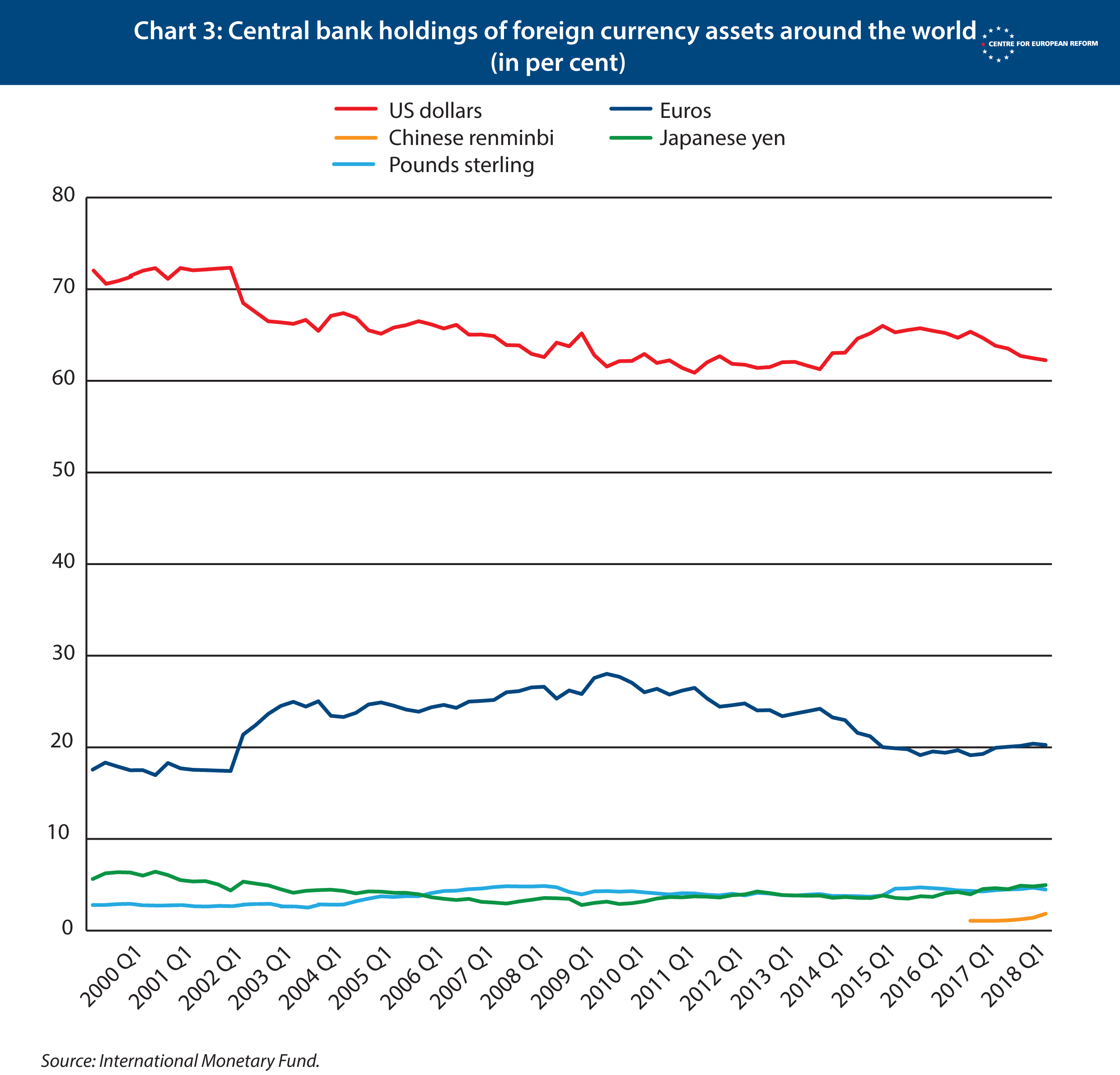

There are risks for banks in emerging markets lending in dollars, because many borrowers’ revenues are mainly in local currencies. This was demonstrated by the Asian financial crisis of 1997. This risk creates an additional demand for safe dollar assets in the form of reserves accumulated by local central banks. Those holdings are available to support local banks in an emergency if the firms they have lent to find themselves in difficulty. Those same dollar reserves are also used by the central bank to stabilise the exchange rates of the local currency. As one recent study has shown, bilateral exchange rates hardly matter for trade; the only rate that really matters is the one vis-à-vis the dollar. In response to the dominance of the US dollar in trade and financial transactions, asset portfolios and credit markets, central banks around the world hold mostly US dollar assets (Chart 3).

Notes: These shares are in per cent of allocated reserves. Ten per cent are not allocated, that is, the currency is unknown.

The power conferred on US authorities by the exorbitant privileges enjoyed by the dollar is made manifest in sanctions. Since almost all large businesses in the world rely on the dollar for their trading and financing, and thus have some ties to the US, those that violate US sanctions run a huge risk. Attempts to replace the SWIFT financial information system, which stands behind almost all bank transfers, with a different one will not do the trick as long as the dollar dominates worldwide transactions.

It is possible to imagine a world in which the dollar and the euro stood side by side as the currencies of two large economic regions of equivalent affluence and involvement in world trade. But for them both to be reserve currencies, they would both need to produce an ample supply of safe assets for foreigners to invest in. The eurozone would also need to demonstrate willingness and ability to stabilise not only its own banks but all the financial actors worldwide that use its currency. Right now the eurozone meets neither criterion of a reserve currency.

The ECB’s stability culture has secured the external and internal value of the euro. But the eurozone’s conservative fiscal policy means that there are not enough safe euro assets to invest in. Thanks to the tight fiscal framework adopted during the winter crisis of 2011-2012, the eurozone’s overall debt-to-GDP ratio is expected to fall from 85 per cent to 71 per cent over the next five years, according to the IMF. The available stock of German Bunds, the safe euro asset of choice, will fall to as little as 42 per cent of German GDP. The US’s, by comparison, is expected to rise to 117 per cent of US GDP.

Countries like Italy have huge financing needs, but their investment grade rating hangs by a thread. Since eurobonds with joint liability are anathema in many member-states, the European Commission has suggested ‘synthetic’ eurobonds without joint liability to create a safe European asset. However, this proposal is still in its infancy, and meets fierce resistance in Berlin and Rome, and lukewarm support in Paris. Other proposals to create European safe assets are equally contested.

A third challenge for the euro’s ambitions was revealed by the banking crisis of 2008. Faced with a run on the dollar-based international banking system, the Federal Reserve rose to the challenge of acting as a lender of last resort not just to American banks, but to banks around the world, above all in Europe. In addition, by way of so-called ‘swap lines’, it provided dollars to the major central banks of the world, in order for them to stabilise their local banks that had dollar funding needs. This prevented banks from fire-selling their dollar assets, which would have triggered a downward spiral in prices of these assets, bringing down banks in the process. The confidence placed by global banks in the dollar as their key currency was amply rewarded.

Faced with a run on the dollar-based international banking system, the Fed rose to the challenge of acting as a lender of last resort. The confidence placed by global banks in the dollar as their key currency was amply rewarded.

Unlike the Fed, the ECB was slow to provide such swap lines – even in its immediate neighbourhood. During the critical phase of the crisis in 2008, the Polish and Hungarian central banks could only borrow at the ECB on the same terms as a commercial bank, against euro-denominated high-quality collateral, which are precisely the kind of assets that are in short supply during a crisis. The reason for ECB caution? The eurozone feared losses if the ECB lent euros freely in exchange for foreign currencies. They were not willing to extend to Poland, a full member of the EU, the same confidence that the Fed extended to Mexico. As the central bank of a reserve currency, the ECB would need to extend its liquidity umbrella. It would need to work with the Commission, the eurozone bailout fund (the European Stability Mechanism), the IMF and the member-states to come up with a consistent framework for providing assistance abroad in times of crisis. Otherwise, banks and financial regulators in other parts of the world will think twice before exposing themselves too heavily to the euro.

Finally, it was not economic factors alone that made the global economy dependent on the dollar. In the early twentieth century, two massive shocks – World War I and World War II – were crucial in disrupting the balance of power in Europe, and ending the pre-eminence of the British Empire, the City of London and hence, the dominant currency of the time, sterling. It is hard to imagine the euro displacing the dollar as the result of a purely ‘business-driven’ process, as many in Berlin seem to imagine. It will take an upheaval to dislodge the current equilibrium of dollar dominance. Donald Trump is doing all he can to provide that shock, and countries around the world are indeed seeking diversification away from the dollar. But the decisive impetus will not come from America alone.

Were the euro to begin emerging as an international lead currency, this would pose new challenges to Europe’s macroeconomic policy stance. There would be strong demand for safe euro assets, pushing down interest rates in Europe – which are already very low. At the same time, demand for the reserve currency as a store of value over and above its function in trade causes it to appreciate. That makes imports cheaper, and exports more expensive. The combination of low interest rates and a strong currency is a difficult environment for an export-led growth strategy.

The eurozone is currently trying to follow the German example: compress wages and domestic demand to boost exports. As a result, the collective current account surplus of the eurozone stands at 3.5 per cent of GDP. Germany could probably live with a stronger euro and maintain its trade surplus and high level of employment. But the rest of the eurozone would struggle.

If the euro became a reserve currency, some core policies would need to change to maintain high levels of employment. Switzerland reconciles the safe haven status of its currency with the export-orientation of its economy only with periodic exchange rate intervention. So far it has accumulated over 750 billion Swiss francs in foreign exchange reserves, that is 89,667 Swiss francs (€79,000) for every man, woman and child in the country. For the eurozone to engage in a similar practice would make it a source of global imbalances even larger than China during its heyday of currency manipulation in the early 2000s.

With a stronger euro and lower interest rates, the eurozone’s macroeconomic policy stance would need to adjust. This would mean rebalancing away from a current account surplus.

Instead, the eurozone’s macroeconomic policy stance would need to adjust. This would mean rebalancing away from a current account surplus. Deeper eurozone public debt markets would feed greater domestic spending and investment. The ECB would need to find new ways to deal with low interest rates. Purchasing government bonds, as it is currently doing, is shrinking the available stock, and is not helpful in providing the world with safe euro assets. The eurozone would need to become ‘banker to the world’: offering safe, short-term euro assets to the world, and recycling the proceeds to invest in long-term risky assets abroad. A public-debt-financed eurozone sovereign wealth fund would be one way of achieving that.

The EU Commission is right to put the euro’s international role on the agenda. If Europe truly wants to be a global political force and be more independent of US leadership, it needs the necessary tools: a common foreign policy and diplomacy, a common European defence policy, and economic policy levers such as its own reserve currency. But the EU should make clear – especially to Germany – that economic policy in the eurozone needs to change if the euro is ever to become a world currency. This is, in fact, the main obstacle: many in Berlin view the attempt to internationalise the euro as a stealthy way to push Germany to accept economic policies it has already rejected. It is up to Germany to decide how much it really wants ‘European sovereignty’.

Adam Tooze is Kathryn and Shelby Cullom Davis Professor of History at Columbia University and Christian Odendahl is chief economist at the Centre for European Reform.

Comments

The present EU blue card, the EU professional card and other card or working visas can be simplified into only EU-issued E-qualifications necessarily required by EU law.

Just my personal view.

Add new comment