The German wage puzzle

Shifts in the relationship between wages and unemployment in Germany mean the European Central Bank (ECB) should continue its stimulus for longer.

The eurozone’s recovery has been powered in part by monetary stimulus in the form of quantitative easing (QE), which the ECB has continued despite comparatively fast growth in 2017. In March 2018, the inflation rate picked up to 1.4 per cent, which prompted demands that the ECB start to withdraw its stimulus. Unemployment across the eurozone is falling fairly rapidly. But the ECB should ignore the temptation to reduce its bond-buying programme for now: wage growth is subdued despite falling unemployment – and Germany appears to be the culprit.

Weak wage growth in Germany – despite unemployment at record lows – should lead the ECB to be cautious about reducing monetary stimulus.

Economists have recently pointed out that the relationship between unemployment and wages has changed in the UK and the US. Usually, low unemployment leads to wage increases, as bosses have to pay more to tempt workers to give up their existing job. Yet the unemployment rate in the UK and US is now where it was in the run-up to the 2008 crisis, while wage growth has been weak. Eurozone unemployment is nearing its pre-crisis level, but just as in the UK and the US, wage growth has also been weak. What is going on?

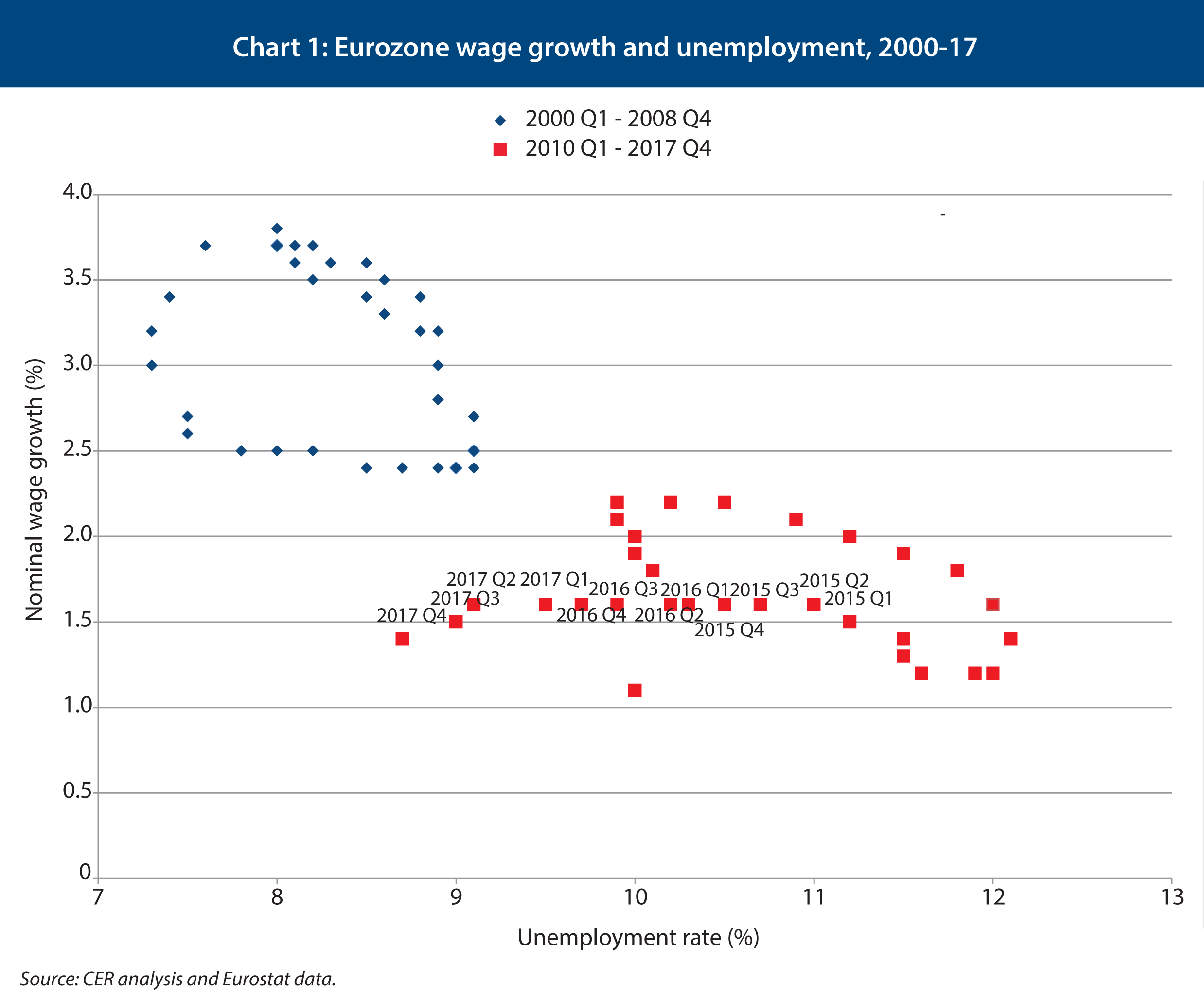

Chart 1 shows the relationship between wage growth and the unemployment rate in the eurozone, for the 2000-08 period, and the 2010-17 period – the so-called wage Phillips curve. The last two economic cycles are clearly visible, and during the euro crisis wages fell as unemployment rose much as they did during the 2001-02 recession. However, since 2015 falling unemployment has not pushed up wages. Rather, wage growth has flatlined between the first quarter of 2015 and the last quarter of 2017, at around 1.5 per cent.

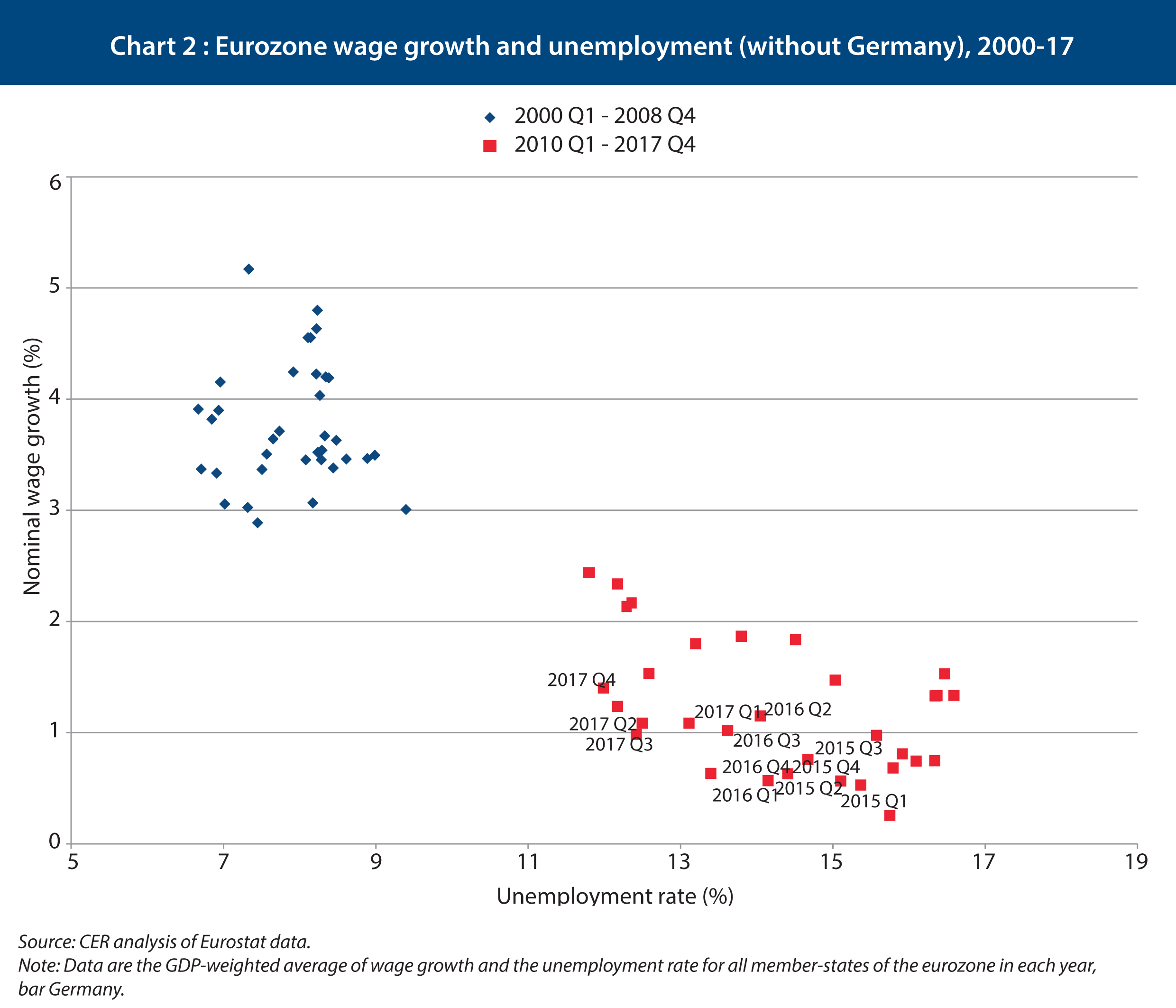

One possible explanation is that faster wage growth is just around the corner, and as the recovery matures the normal relationship will re-establish itself. But there are two reasons to doubt this. First, surprisingly weak data the first quarter of 2018 in France and Germany suggest that the recovery is not as robust as hoped. Second, Germany’s unemployment rate is at record lows and the country is now in its eighth successive year of expansion – and yet, paradoxically, Germany appears to be the cause of the problem. Chart 2 shows the relationship between wage growth and unemployment for all the eurozone member-states apart from Germany. As the unemployment rate has fallen in these 18 countries – by four percentage points between the first quarter of 2015 and the last quarter of 2017 – the rate of wage growth has risen by one percentage point.

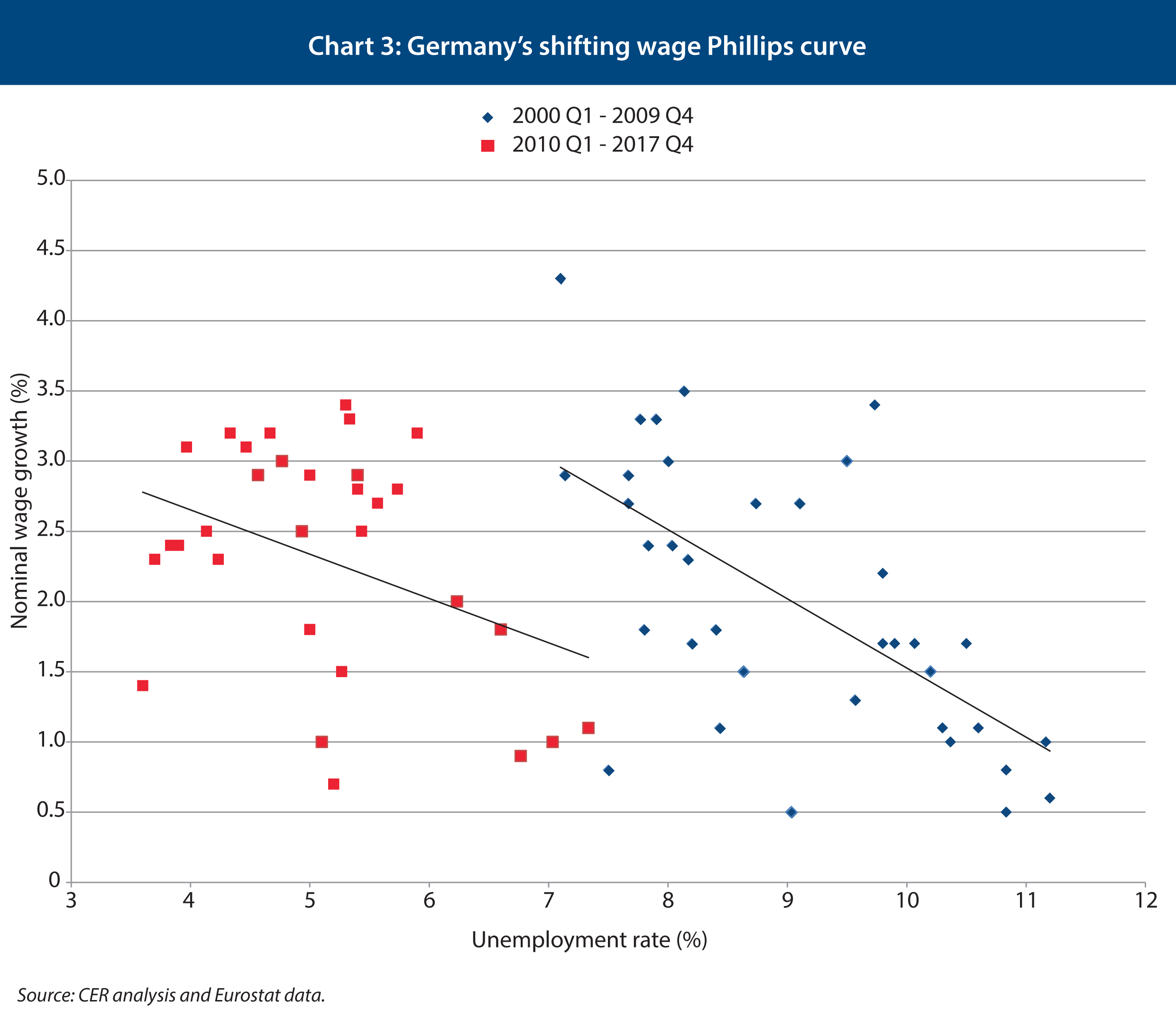

Since 2010, in a similar fashion to the US and UK, Germany’s wage Phillips curve has shifted to the left – which means that it takes a lower rate of unemployment to generate wage inflation. Roughly speaking, Chart 3 shows that the German unemployment rate needs to be approximately 3 to 4 per cent to generate 3 per cent wage growth (in nominal terms). In the previous decade, the unemployment rate needed to be in the 7.5-8.5 per cent range.

Germany’s low unemployment is not pushing up wages as in past periods of growth. This has implications for the ECB.

Christian Odendahl explained the reasons for this change in a 2017 CER policy brief. German workers have seen weak wage growth for decades. In the 1990s, high unemployment and the threat of offshoring to central and eastern Europe convinced unions to accept wage restraint in order to preserve jobs. In the mid-2000s, the ‘Hartz’ labour market reforms reduced unemployment benefits and reduced the amount of time they were paid for. The government provided more job centre services and training. This pushed many people on the fringes of the labour market into work, which was often part-time and low-paid. And after 2010, Germany led the charge in Europe for fiscal rectitude, curbing public expenditure in a period of weak private sector demand, which in turn curtailed the demand for labour as its supply was increasing.

On the one hand, these developments ensured that the German labour market has come to resemble that of the UK, with high employment rates, low unemployment rates, a larger number of low-skilled and low-paid jobs than other European countries, and higher income inequality. It also meant that Germany’s unemployment rate only rose a few points in the Great Recession, despite a significant hit to GDP. The labour market reforms were in many respects a good thing: periods of unemployment tend to lead to a pay penalty in the long-term, as people are disfavoured by employers, get depressed, anxious or physically ill, or drop out of the labour force. A lower ‘structural’ rate of unemployment means that fewer people are out of work for long.

But together, these changes increased the supply of labour in Germany and lowered the rate at which unemployment would generate wage inflation. They have also had an impact on the eurozone as a whole. Persistent low wage growth in Germany led to big current account surpluses, since it held down the growth of consumption and imports. The savings of the German corporate sector were reinvested elsewhere, helping to inflate asset bubbles in Spain, Portugal, Ireland and Greece, which popped between 2008 and 2012.

And now, the shift in Germany’s Phillips curve makes life difficult for policy-makers at the European Central Bank. The ECB has not managed to maintain its inflation target of ‘below but close to 2 per cent’ since 2013, and in recent months the inflation rate has hovered a little above 1 per cent. Germany’s economy makes up around 30 per cent of the eurozone as a whole, and slow wage growth – despite the maturity of Germany’s economic recovery – has been the main reason why wage inflation in the eurozone has flatlined, despite falling unemployment. The ECB should continue to provide stimulus until it has become clear that German domestic demand has picked up in a sustained fashion, with wages rising at a rate commensurate with meeting its inflation target for the eurozone as a whole.

The likelihood of rapid inflation and wage growth in other member-states looks slim. When unemployment in France and Spain was at its lowest in the last decade, nominal wages in those countries grew between 3.5 and 5 per cent. Now France, Spain and Italy’s wages are growing at a slower pace because unemployment remains elevated, and ‘underemployment’ – people working part-time, but who would like to work more hours – is also high. Despite record-low unemployment, wage growth in Germany has averaged just 2.5 per cent growth since 2014. This suggests that the ECB should resist the temptation – and the calls of northern European hawks – to withdraw monetary stimulus until it is clear that full employment has been achieved in Germany, and the rate of inflation and wage growth rises. We do not appear to be there yet.

John Springford is deputy director of the Centre for European Reform.

Comments

Add new comment